High Tech and Corruption Risks

Silicon Valley should take note. They are ripe for aggressive FCPA enforcement. The high-tech industry is a risk industry for bribery violations. Yet some say that the high-tech industry is behind the curve when it comes to anti-corruption compliance.

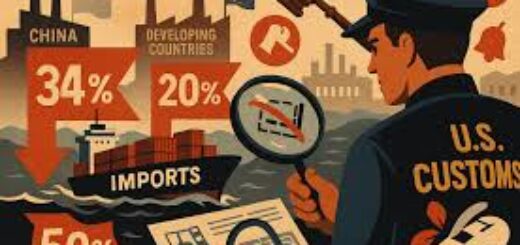

The high-tech industry outsources a significant amount of manufacturing. They rely on production and related services in countries where the risk for corruption is extremely high, especially China, Taiwan and South Korea.

China is ranked 78 out of 178 countries on the Transparency International Corruption Perception Index; Taiwan is 33 out of 178; and South Korea is 39 out of 178.

China is the focus of anti-corruption enforcement because of its significant economic role in the high-tech sector (and other sectors as well). In China, corruption costs are estimated at 3 percent of GDP. Since 2002, DOJ/SEC have brought over 40 enforcement actions in China (18 percent of all enforcement actions).

The Chinese business culture is based on relationships, or guanxi, which are formed in part by giving gifts and doing favors. The FCPA (and the UK Bribery Act) include broad interpretation of “thing of value” which encompass all types of gifts, travel, and entertainment.

A quick examination of some of the prior enforcement actions is a laundry list of these types of violations: non-business related travel to company officials (Lucent); internships to Chinese official’s son and girlfriend, letters to obtain visas and use of vehicle (Daimler AG); payment for college tuition for children of two executives (Control Components); gift certificates and watches (Schnitzer Steel); $4500 in gifts to Chinese telecomm executive (Veraz); watches, cameras and laptop computers (Alliance One); laptop computers, jade, fur coats, kitchen appliances, business suits and expensive liquors (RAE Systems).

The Chinese government has a significant and direct stake in the economy, both through state ownership and through stock ownership 70 percent of productive wealth in China is owned by the government. Consider some of the prior enforcement actions: payments to Chinese steel producers either wholly or partially owned by Chinese government (Schnitzer Steel); payments made to Chinese oil company Sinopec (publicly traded on NYSE but 75% owned by Chinese government (Daimler).

For the high-tech sector they need to ramp up high-risk compliance efforts. Such programs have to be carefully tailored to the unique challenges and risks in Asian economies and cultures.

Michael,

The message that high tech and Silicon Valley are ripe for aggressive FCPA enforcement has been given forcefully and repeatedly at probably 15 conferences, 20 or more law firm presentations and annual ACC programs in the Bay Area in the past 6 years. Feeding the speculation the government was going to start enforcement, the SEC opened a Bay Area FCPA office to some fanfare 2 years ago. Despite all the dire predictions, there have been virtually no actions brought or serious fines levied against high tech companies, so nothing has grabbed the attention of corporate management (though the current HP matter has the potential to change that).

It is odd that you point to supplier relationships in China as a probably source of FCPA problems. The supply side is not the main source of FCPA risk for tech companies. A much larger risk is the high tech sector’s extreme reliance on sales channels for international business and many companies’ poorly informed, inconsistent, hands off management of those channels. China does seem to be the US government’s focus for FCPA enforcement. But corruption in the high tech sector – and all industries – exists everywhere in the world as companies scramble for business in corrupt environments with very little assessment of the risks. Compared to other countries, China may be a large supplier of products, but is just one of many markets for sales, technology transfers and service transactions by US technology companies, and those are the types of transactions which have a much greater potential for bribery.

I do agree with your generalization that the technology sector is behind the curve in getting anti-corruption compliance programs in place – but again that message has been given at every presentation on the FCPA in the bay area for the past 6 years and there is not much evidence it has had a significant impact on corporate compliance programs. The tech sector remains a target rich environment for FCPA investigations, and not many companies have compliance programs which would qualify them for credit under the Federal Sentencing Guidelines or the DOJ’s very clear Attachment C guidance.

To date FCPA enforcement has been a boogie man story to silicon valley executives. When the stock option backdating matter hit a few years ago, roughly 100 tech companies were investigated in a year or so, senior executives and general counsels lost their jobs, everyone got the message and cleaned up fast. The stock option backdating scandal showed the government can act when it wants to and companies will react. If the government mounted a similar concerted investigation in the FCPA area, it could probably bring a similar number of cases in the tech industry and management would react.