The (Relatively) “New” Model for Corporate Criminal “Investigations” (Part I of IV)

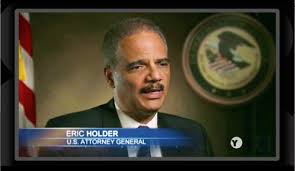

The Justice Department continues to be dogged by questions surrounding its conduct of criminal investigations. These concerns are being raised in the context of extreme cynicism given DOJ’s “failure” to prosecute individuals from the financial crisis last decade.

The Justice Department continues to be dogged by questions surrounding its conduct of criminal investigations. These concerns are being raised in the context of extreme cynicism given DOJ’s “failure” to prosecute individuals from the financial crisis last decade.

Whether it is accurate or not, the public and many politicians view DOJ’s lack of aggressive prosecutions as a significant failure. I am not going to address that question but want to at least note it for context.

Over the last decade, DOJ has transformed “traditional” tools used to investigate criminal cases. Part of the reason is that DOJ has extended criminal liability into areas that were usually enforced through civil and regulatory actions. Criminal prosecutions are now seen as a faster and more effective means to enforce laws and regulations.

For example, off-label marketing prosecutions in the 1990s were routinely handled through regulatory enforcement by the FDA of the Food, Drugs and Cosmetics Act. Starting in the 2000s, criminal prosecutions of the same requirements were routine and large fines were imposed.

When I use the term “traditional” criminal enforcement, I am referring to use of grand juries to conduct complex investigations that were resolved by an indictment or declination. In the traditional context, there were no deferred prosecution agreements or non-prosecution agreements. Companies were either indicted or there was no criminal case brought against them.

That model no longer exists. Whether it is the appropriate or the only model that should be used is no longer a relevant question. Contrary to some FCPA Paparazzi, we cannot turn back the clock and it is no longer an option to return to the days of indictments or declinations. We live in a different world but there are still significant issues that need to be examined in this new framework.

In the next few postings I plan to review some of the issues and discuss the implications of this new model.

In recent weeks, DOJ and SEC officials have been giving speeches to defend the new model and to encourage some different behaviors by companies under investigation. In the new model of criminal prosecution, prosecutors have delegated the bulk of the investigation function to outside counsel representing corporations. It is rare for prosecutors to conduct a complex grand jury investigation by issuing subpoenas and reviewing documents. Companies are relying on outside counsel to conduct such inquiries and then having outside counsel report the results to DOJ prosecutors.

DOJ has significantly increased its investigative abilities by leveraging its resources to oversee the investigations and direct outside counsel to ensure that a robust investigation is completed. This strategy however comes with a cost — the investigations are not conducted with the same incentive or the quality that DOJ prosecutors would apply when conducting its own investigation. To suggest that everything is still the same, would be naive.

In this new model, DOJ has more management responsibilities and has to ensure that incentives are appropriately calibrated to motivate corporate outside counsel. DOJ’s primary carrots/sticks tools are avoidance of a criminal charge, reduced fines and cooperation credit.

DOJ has fallen into some traps along the way. Whether it is true or not, DOJ has been viewed as lax on charging individuals. Also, DOJ has been criticized for using NPAs and DPA and letting companies escape any liability in exchange for agreeing to a corporate monitor and imposing a detailed set of compliance requirements.

DOJ has fallen into some traps along the way. Whether it is true or not, DOJ has been viewed as lax on charging individuals. Also, DOJ has been criticized for using NPAs and DPA and letting companies escape any liability in exchange for agreeing to a corporate monitor and imposing a detailed set of compliance requirements.

DOJ responded to these criticisms by attempting to increase individual prosecutions and forcing more companies to plead guilty to criminal charges, along with paying fines and agreeing to a monitor and/or detailed set of compliance requirements.

DOJ is again seeking to increase individual criminal prosecutions. Recently, Criminal Leslie Caldwell, and SEC Enforcement Chief Andrew Ceresney gave speeches (Caldwell Here; Ceresney Here) to encourage companies to identify culpable individuals as part of a corporate effort to earn cooperation credit. DOJ claims that it “pressure” tests investigations conducted by outside counsel and intends to demand greater focus on individual culpability.

AAG Caldwell’s recent comments raise an interesting question. In order to satisfy corporate criminal liability requirements, DOJ is required to identify at least one individual who acted with the requisite intent and satisfied the elements of the crime. That individual (or individuals’) conduct is then attributed to the company for criminal liability purposes.

In reviewing investigations conducted by outside counsel, DOJ has (or should have) been focusing on potential criminal cases against individuals in order to determine corporate liability. Yet, AAG Caldwell’s comments suggest that DOJ may not have been as vigilant, and that company investigations were not focused sufficiently on potential culpable individuals. It is hard to understand exactly how DOJ was reviewing and supervising these cases, or if they were just scratching the surface to confirm corporate liability. Whatever the reason, one thing is clear – DOJ wants to prosecute more individuals and wants to see company investigations serve up more individuals for criminal prosecution.

1 Response

[…] The FCPA Blog has the first of a four-part series on the mystery of China compliance. The FCPA Professor looks at a Texas Supreme Court decision upholding Shell Oil’s claim that an internal investigating reporting of FCPA violations is privileged communication under defamation laws. Mike Volkov starts a five-part series on corporate criminal investigations. […]