Refining a CCO’s Reporting Relationship to a Corporate Board

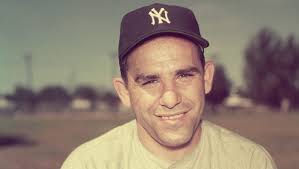

You can observe a lot by just watching – Yogi Berra

You can observe a lot by just watching – Yogi Berra

There is way too much time being spent on esoteric arguments about corporate board reporting responsibilities for Chief Compliance Officers. Let’s agree and move on to more important and difficult issues. I hate to be dogmatic but when it comes to this issue, there really is one obvious solution. Varying alternatives are less than efficient and should be discarded.

Lets start with these basic headlines and then I will explain why people are wasting time with hypothetical manipulations –

(1) A CCO should report to a senior executive, preferably the CEO on a day-to-day basis;

(2) A CCO should report directly to the Board at least four times a year to the responsible board committee, and at least once to the entire board. The reporting session should include an executive session during which the CCO reports privately to the board committee on any issues of concern to either the board or the CCO.

(3) The CCO should have a dotted line authority to report directly to the board, and circumvent the CEO and senior management, when necessary. This last point is the important one – a dotted line authority is just that – dotted – so that it reflects a possibility, usually rare or once in a lifetime for a CCO, when the CCO cannot report directly on an issue to a CEO because the CEO or other senior manager is involved, disqualified or engaged in misconduct. This so-called nuclear option is a rare occurrence.

Assuming you are with me on these three basic assumptions, with some slight variations in some situations, then we turn to discard other approaches to this issue.

A CCO should not report directly to the board or the responsible committee on day-to-day issues. A dotted line should not turn into a solid line. A board is not equipped to manage compliance functions on a day-to-day basis. Such a reporting relationship will undermine a compliance program by giving the CCO too much ability to decide basic issues that may require the approval and support of the CEO and senior management.

If a CEO or senior management is not addressing a specific day-to-day issue, such as staffing or technology needs, the CCO has the ability to raise these types of day-to-day issues with the board in a quarterly report, or preferably in ongoing informal discussions and meetings with the board committee chair. A CCO has to maintain informal communications with the board committee chair as part of a best practices reporting regime.

Too many so-called board governance experts confuse the purpose of the CCO’s dotted line to the board and engage in theoretical and unnecessary mental scenarios designed only to confuse the issue rather than bring clarity and simplicity to the division of reporting obligations and practical solutions.

Too many so-called board governance experts confuse the purpose of the CCO’s dotted line to the board and engage in theoretical and unnecessary mental scenarios designed only to confuse the issue rather than bring clarity and simplicity to the division of reporting obligations and practical solutions.

So-called governance experts often try to confuse issues rather than look for practical solutions. It is antithetical to their so-called “expertise” and need for self-justification. Common sense is a powerful force that can be relied on as an effective tool for problem solving. Unfortunately, in the GRC space sometimes we see what Voltaire said – “Common sense is sometime not so common.”