Turning the CEO Around: How to Make Sure the CEO Embraces Ethics and Compliance

Your CEO is either on board for compliance, or he/she is not. There is no half-way mark here, no way to deceive or soft-shoe your way through the compliance requirement.

Your CEO is either on board for compliance, or he/she is not. There is no half-way mark here, no way to deceive or soft-shoe your way through the compliance requirement.

Yet it is common to see a CEO who is not committed and a Chief Compliance Officer who is in denial and points to half-hearted steps to justify their own self-deception. CCOs need to take an honesty pill and deal with the truth – your CEO is either with you or against you.

Once the CCO is forced to face reality – they have two alternatives with a non-committal CEO. First, they can speak with their feet and leave – I am not advocating that (depending on how bad the situation is).

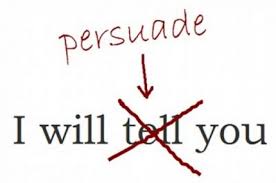

If the situation can be changed, then the CCO needs to get started on doing so. How do you make the CEO respond to, and embrace, the importance of compliance?

The CCO has to build a constituency of senior executives and push for change by the CEO. In other words, the CCO has to build alliances, convince the other senior leaders that the CEO needs to be pushed on the compliance issue, and then has to carry out the plan.

This is not like an intervention – it is a longer term project. It requires some consistency and honest discussions.

The most effective way to bring the compliance message to the CEO is through a senior compliance committee. Most companies have a senior compliance committee consisting of leaders from important functions, including HR, audit, legal, operations, security, and information technology.

A compliance committee can be an effective means to bring together all of the compliance actors and coordinate implementation of compliance strategies and functions. It is a more effective means of coordination than emails and telephone calls to cajole people into taking affirmative compliance steps.

A compliance committee also serves a valuable function in reporting to the CEO on important compliance priorities. An internal compliance communications campaign can help to promote a compliance message and influence key actors to embrace compliance.

With time and education, the compliance committee, if committed, can begin to influence the CEO through communications to the CEO from the committee as to the committee’s actions and priorities. In other words, instead of the CCO asking the CEO to act, the CCO can use the compliance committee to message to the CEO the importance of embracing the compliance message.

As an alternative or an additional measure, the CCO could bring the board into the issue, as well – assuming the CEO does not sit on the board. If the CEO does sit on the board, then the CCO has to be careful and give the CEO the opportunity to embrace various compliance priorities described to the board. The CEO may see the handwriting on the wall and the importance of embracing the compliance message as a personal priority.

Unfortunately, this overall strategy of bringing the CEO to the compliance table takes valuable time away from other important compliance priorities. Frankly, the CCO will have to devote at least a year to this process to get the CEO to change his or her behavior. It is unfortunate, but it is a cost of doing business with a non-attentive CEO.

Unfortunately, this overall strategy of bringing the CEO to the compliance table takes valuable time away from other important compliance priorities. Frankly, the CCO will have to devote at least a year to this process to get the CEO to change his or her behavior. It is unfortunate, but it is a cost of doing business with a non-attentive CEO.

Corporate governance expectations need to change and include a new approach for CEOs – one that embraces compliance as an important priority. Too many CEOs are raised in a business culture that slavishly focuses on quarterly financial performance. Corporate performance is not just defined by quarterly financials but long-term sustainable growth that transcends the vagaries of up and down twists in the economic cycle. Forward-looking CEOs recognize this and are starting to develop a new mantra – ethics and compliance contributes to the bottom-line and is an important factor in overall corporate sustainability.