Bribery Requires – Money

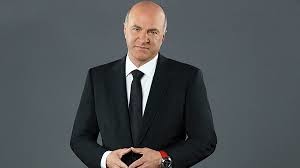

I have to confess – I love the show Shark Tank. Mr. Wonderful, Kevin O’Leary, is my favorite Shark. Mr. Wonderful often reminds the contestants and other Sharks that the central issue in considering business proposals is – How do I make M-O-N-E-Y?

I have to confess – I love the show Shark Tank. Mr. Wonderful, Kevin O’Leary, is my favorite Shark. Mr. Wonderful often reminds the contestants and other Sharks that the central issue in considering business proposals is – How do I make M-O-N-E-Y?

The same focus on money has to be at the core of any anti-corruption compliance program. In examining a company’s risk profile, the central focus has to be on how corrupt individuals within a company can get access to money.

In keeping with my long line of profound grasps of the obvious, it goes without saying that bribery requires money (or other items of value). So the question is how can employees and third parties gain unauthorized access to money?

There are a number of common schemes used by corrupt company employees to secure access to money for bribery. These include:

Third Party Agents/Distributors: We all know about the risk created by use of third-party agents, distributors and other types of intermediaries. Congress was well aware of the risk that companies prohibited from engaging in foreign bribery would turn to third parties as a means to circumvent the bribery prohibition. As a result, Congress included tough provisions in the FCPA to prohibit companies from using third parties to carry out schemes that companies could not accomplish directly.

Applying the money mania focus, companies have to apply strict controls to payments made to third parties: invoices have to be carefully verified for services, inflated pricing or other means to transfer money; discounts have to be verified as justified and reasonable; and marketing funds or other transfers given to distributors have to be monitored and audited on a continuing basis.

Shadow/Fake Third Party Vendors: Corrupt company employees often use shadow vendors who submit fake invoices for non-existent goods or services. A company’s due diligence system has to include robust procedures for onboarding vendors and monitoring payments to vendors to verify compliance. Many companies fail to understand the extent of risks from shadow vendors, and need to reexamine their vendor/procurement operations.

Gifts, Meals, and Entertainment: A regular source of money misuse relates to gifts, meals and entertainment expenses. The risk in this area is not just giving gifts, paying for lavish meals or entertainment, it is the ease with which employees can get access to money and use such funds for pure bribery payments. Sometimes bribes can be given through lavish gifts, meals and entertainment.

To mitigate the risks of bribery, companies have to establish robust controls through prospective approvals and monitoring of expenditures. Large expenditures for gifts, meals and entertainment have to be reviewed and approved in advance. Similarly,  companies have to monitor and record who is providing the gifts, meals and entertainment and who is receiving the gifts, meals and entertainment, especially if the recipient is a government official.

companies have to monitor and record who is providing the gifts, meals and entertainment and who is receiving the gifts, meals and entertainment, especially if the recipient is a government official.

Fake Paperwork: A common mechanism for carrying out bribery is the use of fake receipts, especially in China and other Asian countries, and fake or inflated invoices. Controls have to be designed around these high-risk mechanisms to ensure that invoices and receipts are verified.

Petty Cash: Five to ten years ago, FCPA cases often involved misuse of petty cash funds. In response, many companies are eliminating petty cash funds. It is a good practice and more companies have to eliminate this source of funds as a means to gain unauthorized access to funds.

2 Responses

[…] big banks just received a regulatory kick in the ribs. Mike Volkov says you can’t have bribery without money. Richard Bistrong discusses international business attitudes toward corruption. Tom Fox visits the […]

[…] Read Full Article: Bribery Requires – Money – Corruption, Crime & Compliance […]