Parent Company and Subsidiary Liability for FCPA Violations: Fighting the Disinformation Campaign

Akin to politics (to a smaller degree), there is a fair amount of disinformation, some call it bloviating, put out by the FCPA Paparazzi. Some of this disinformation is motivated by immature attempts to “market” legal services; other sources of disinformation carry a readily apparent bias, one way or the other, and usually are supported by self-citations to one’s own “scholarship” to prove their points.

Akin to politics (to a smaller degree), there is a fair amount of disinformation, some call it bloviating, put out by the FCPA Paparazzi. Some of this disinformation is motivated by immature attempts to “market” legal services; other sources of disinformation carry a readily apparent bias, one way or the other, and usually are supported by self-citations to one’s own “scholarship” to prove their points.

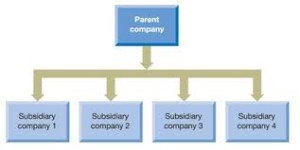

One specific area where disinformation has been disseminated is surrounding the issue of parent-subsidiary liability for FCPA violations. The issue can carry some importance when debarment or other collateral consequences are imposed against a parent company for violations committed by a subsidiary. I will attempt to set out the facts and cite the law to understand exactly how such liability is created and when it can be imposed.

Books and Records and Accounting Controls

Let’s start with the easiest area first – the SEC has imposed a strict liability standard against parent companies for books and records and accounting violations when subsidiaries engage in bribery. No one has questioned the SEC’s authority to impose liability for books and records and accounting violations under the plain meaning of the law.

Books and Records: Under 15 USC Section 78m(b)(2)(A), an issuer is required to make and keep books, records and accounts, which in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the issuer.

Internal Controls: Under 15 USC Section 78m(b)(2)(B), issuers are required to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurances that management has control, authority and responsibility over the firm’s assets.

If a Company Subsidiary in Country A engages in bribery in Country A, and falsely records the expenses as “marketing” in its books and records, the Parent Company will be liable for the books and records violation. Company Subsidiary A has made false entries in its books and records which are then consolidated and reported by Company Parent in its consolidated financial statements.

Company Parent is also liable under the internal controls provision for failing to devise internal controls across the organization to detect and prevent the improper payments to foreign officials.

Anti-Bribery Provisions

The harder case of parent-subsidiary liability involves bribery charges. The FCPA’s anti-bribery provisions apply to issuers and their employees and agents as well as “domestic concerns” and their employees and agents.

A parent company may be liable for bribes paid by its subsidiary under two common scenarios – first, when the parent company participated sufficiently in the activity to be held directly liable (either directed or participated in the conduct); and second, a parent company may be held liable for a subsidiary’s conduct under traditional agency principles. The adoption of an agency standard by DOJ and the SEC is relatively new and expands on prior statements as to when prosecutors would hold a parent company liable for bribery.

Under the agency theory, there are relatively few situations where DOJ and the SEC cannot impose liability for bribery committed by a subsidiary. This theory, while attractive on its face, is problematic. The application of agency principles to legal liability determinations conflates liability with traditional agency law. The doctrine of respondeat superior clearly applies to agents who commit FCPA violations that are, in part, intended to benefit the parent company. This analogy however, does not so easily apply to imposing liability simply because a subsidiary is an agent of a parent company. Under the DOJ and SEC reading of the law, a subsidiary is invariably an agent of the parent company and its conduct can be imputed to the parent company. It is hard to think of a circumstance when, under DOJ and SEC analysis, a subsidiary company could not be classified as an agent of a parent company.

DOJ and the SEC need to provide some clarity on this issue. As stated in the FCPA Guidance, the formal relationship between the parent and the subsidiary is an important starting point in the analysis but the SEC and DOJ claims they will look at the “practical realities” of the relationship between the parent and the subsidiary. In recent years, the SEC has aggressively stretched agency principles to impute parent liability for subsidiary conduct. There are a number of examples of this aggressive approach, including PTC (Here); SciClone (Here); Alcoa (Here, Paragraph F); Bio-Rad (Here)

DOJ and the SEC need to provide some clarity on this issue. As stated in the FCPA Guidance, the formal relationship between the parent and the subsidiary is an important starting point in the analysis but the SEC and DOJ claims they will look at the “practical realities” of the relationship between the parent and the subsidiary. In recent years, the SEC has aggressively stretched agency principles to impute parent liability for subsidiary conduct. There are a number of examples of this aggressive approach, including PTC (Here); SciClone (Here); Alcoa (Here, Paragraph F); Bio-Rad (Here)

The SEC can always cite, and will when necessary, general interactions between a parent company and a subsidiary. The existence of these interactions, by themselves, without any connection to the alleged bribery scheme raises significant enforcement concerns and questionable legal theories to impute subsidiary conduct to parent companies.

Excellent article Mike. The topic is critical and many times ignored in decisions by relevant players.

When you talk about the parent company, are you referring to companies subject to FCPA who control the foreign subsidiary?

Another scenario: If the company subject to FCPA (eg a US-based corporation) owns a minority interest in the foreign subsidiary, which is under control of a company not subject to FCPA (eg based in a European or Asian country and does not quote stock or debt under the SEC), would you say that the US-based company may not bu subject to FCPA liability for the actions of the foreign subsidiary and it may be subject to FCPA liability for its own actions?