DOJ and SEC Deliver Body Blow to Private Equity and Hedge Funds: Och-Ziff Settles FCPA Violations for $412 Million (Part I)

The Justice Department and the Securities Exchange Commission delivered a powerful FCPA enforcement message to private equity and hedge funds. Och-Ziff settled with the DOJ and SEC for total penalties of $412 million.

The Justice Department and the Securities Exchange Commission delivered a powerful FCPA enforcement message to private equity and hedge funds. Och-Ziff settled with the DOJ and SEC for total penalties of $412 million.

The comprehensive enforcement action and settlement included: (1) a 3 year deferred prosecution agreement (“DPA”); (2) a criminal plea to four criminal counts, two FCPA conspiracy counts, and a books and records and internal control violations, respectively; (3) appointment of a three-year monitor; and (4) individual SEC settlements with Och-Ziff’s CEO Daniel Och for $2.2 million, and CFO Joel Frank for a yet to be determined amount.

Interestingly, the Och-Ziff enforcement action appears to have been initiated from the SEC’s industry inquiry launched in late 2010. The SEC began an inquiry against private equity and hedge funds in 2010 by issuing information requests to approximately 10 separate entities. The inquiry focused on interactions with sovereign wealth funds and compliance controls implemented by private equity and hedge funds.

When the dust settled on this action, and after reviewing the comprehensive factual presentations by the Justice Department and the SEC, the picture painted of Och-Ziff’s commitment to bribery and ignoring mountains of red flags of corruption risks is overwhelming.

The lessons learned from Och-Ziff are numerous. Some of the deficiencies reflect common risks and failures to act. Other deficiencies raise new bars in handling basic private equity and hedge fund transactions.

Given the important lessons from this enforcement action, I plan to take multiple posts to review the entire enforcement action. The bribery schemes were intricate but basic in implementation.

The implications of the Och-Ziff enforcement action for private equity and hedge funds are enormous. No longer can private equity and hedge funds make token compliance efforts, rely on paper programs, and display a basic disregard to FCPA compliance. Och-Ziff is a watershed enforcement action that should send repercussions through the entire private equity and hedge funds industry.

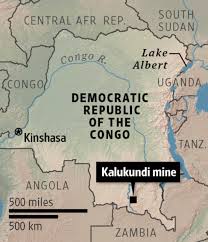

Och-Ziff’s bribery conduct was centered in various countries in Africa. The bulk of the schemes occurred in two countries: Libya and the Democratic Republic of the Congo (DRC).

Additionally, Och-Ziff engaged in prior schemes in other African countries in Chad, Niger, Guinea and Zimbabwe. In a related criminal action, on August 16, 2016, DOJ arrested and indicted Samuel Mebiame, a Gabonese intermediary, who assisted Och-Ziff by funneling bribes to foreign officials in Chad and Niger to secure valuable mining concessions.

Och-Ziff paid millions in bribes to high-level officials across Africa. The DRC bribery scheme involved a corrupt partnership with an Israeli businessman operating in the DRC’s diamond and mining industries (“DRC partner”). The DRC Partner had gained unique access to investment opportunities in the DRC by making corrupt payments to senior government officials in the DRC. Och-Ziff entered into a series of transactions with the DRC partner with the understanding that large portions of the amounts would be transferred to DRC foreign officials. Ultimately, Och-Ziff made more than $90 million in profits from the various investment opportunities.

In Libya, Och-Ziff engaged a third-party agent to assist the company to secure an investment from the Libyan Investment Authority (LIA), Libya’s sovereign wealth fund, knowing that the agent would have to pay bribes to Libyan officials. The agent  was engaged without any formal due diligence, or the execution of a written contract. Eventually, Och-Ziff entered into a written contract and backdated the starting date to over a year earlier. The agent was able to secure a $300 million placement at Och-Ziff.

was engaged without any formal due diligence, or the execution of a written contract. Eventually, Och-Ziff entered into a written contract and backdated the starting date to over a year earlier. The agent was able to secure a $300 million placement at Och-Ziff.

Och-Ziff paid the agent approximately $3.75 million as a “finder’s fee,” which was false, knowing that all or a portion of the fees would be paid to Libyan officials. The payment was based on a sham consulting contract between Och-Ziff and the agent.

Och-Ziff failed to conduct proper due diligence on numerous occasions, paying little to no attention to existing anti-corruption policies and procedures. Just as significant, Och-Ziff’s financial controls were defective in failing to monitor, review and understand large financial transactions that were vehicles to fund bribery schemes, particularly in the DRC.

1 Response

[…] Read Full Article: DOJ and SEC Deliver Body Blow to Private Equity and Hedge Funds: Och-Ziff Settles FCPA Violations fo… […]