The “New” Face of Corporate Misconduct

As we look across the corporate governance landscape and focus on the spikes of corporate scandals, I started to wonder if there was any pattern or trend to the nature of corporate scandals.

As we look across the corporate governance landscape and focus on the spikes of corporate scandals, I started to wonder if there was any pattern or trend to the nature of corporate scandals.

In the early 2000s, the country was rocked by financial accounting scandals and massive fraud in corporate reporting. In response, the Sarbanes-Oxley reforms were enacted, transforming the auditing and financial reporting requirements. Sarbanes-Oxley had a dramatic impact on corporate reporting, corporate governance and implementation of internal controls.

In the late 2000s, the financial scandal centered on the sale of questionable security products that were based on questionable loan documents. Financial institutions did not accurately disclose the known risk of these products, and failed to maintain adequate reserves in the case of massive losses from these documents. In response, Dodd-Frank reforms were enacted to require increased regulatory review and disclosures related to risky securities and financial institutions were subject to increased capital reserve requirements.

The new iteration of corporate misconduct is exemplified in General Motors, Wells Fargo, Volkswagen, VimpelCom and Takata (and numerous other incidents). Of course, there are continuing accounting scandals linked to SOX violations, and there continue to be fraud schemes focused on the sale of risky securities and failure to disclose.

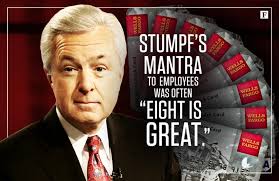

Every corporate scandal boils down to greed – but greed can manifest itself in a variety of contexts. GM, Takata, Wells Fargo and Volkswagen reflect a failure of corporate governance, internal controls and corporate compliance programs, including safety issues, to promote ethical and compliance with the law. Wells Fargo stands alone with its avoidance of any ethical consideration of the new sales incentive program, and a complete failure to promote a speak up culture. In fact, when internal concerns were raised, the employees who voiced those concerns were fired.

Similarly in the GM and Takata, profit concerns outweighed the need to address serious safety concerns. Again, when internal concerns were raised, the lawyers and senior engineers failed to address those concerns. Similarly, in Volkswagen, when internal concerns were raised to senior engineers who designed the cheating software, they quickly shut down the issues raised by staff engineers.

VimpelCom, one of the most important FCPA prosecutions over the last five years, confirmed failures in basic corporate governance operations, from the board, to the legal staff, and to the internal auditors. AT the heart of the breakdown, was the failure of the board to consider and resolve the basic issue of who was the own of the shell companies through which VimpelCom was acquiring cellular licenses in Uzbekistan.

In sum, the new face of corporate misconduct can be described as a failure of corporate governance and critical functions such as board oversight and supervision, ethical business decision making, lack of a speak up culture and failures of critical compliance functions such as legal and audit to carry out their responsibilities. It may be a large trend but at bottom corporate governance is a requirement that begins at the top of the organization and is consistently carried out through the rest of the company.

In sum, the new face of corporate misconduct can be described as a failure of corporate governance and critical functions such as board oversight and supervision, ethical business decision making, lack of a speak up culture and failures of critical compliance functions such as legal and audit to carry out their responsibilities. It may be a large trend but at bottom corporate governance is a requirement that begins at the top of the organization and is consistently carried out through the rest of the company.

In response to this trend, and assuming it continues along this path, legislative and regulatory pressures will increase to address these concerns. Congress will seek simple solutions to a complex set of problems, and I expect that we may witness another set of legislative mandates around the corporate governance and compliance function, building on a historical record of solutions and tools that have been used by various enforcement agencies.

1 Response

[…] Read Full Article: The “New” Face of Corporate Misconduct – Corruption, Crime & Compliance […]