False Claims Act 2018 Year in Review – Making Sense of the DOJ Fraud Statistics

Jessica Sanderson, Of Counsel, The Volkov Law Group, joins us for her initial posting on the False Claims Act. Jessica can be reached at [email protected].

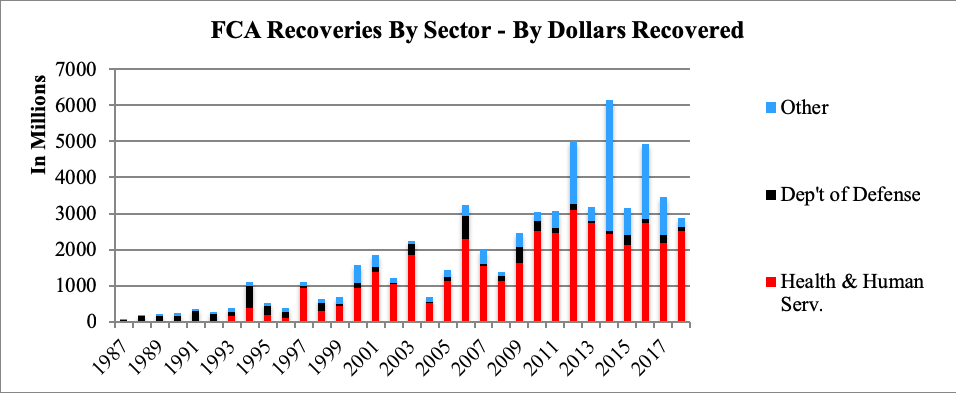

On December 21, 2018, the Department of Justice (“DOJ”) released its Fraud statistics showing $2.8 billion recovery under the False Claims Act (“FCA”) for 2018.[1] While this number is staggering, fiscal year 2018 FCA recoveries were down more than ½ billion dollars from 2017.[2] In fact, 2018 recoveries are the lowest we have seen since 2009.

In this article, we simplify the DOJ statistics by creating graphics that reveal patterns and trends. We then highlight some of the policy developments over the year. Along the way we discuss practical applications and make a few predictions for 2019. This article is not intended to be a comprehensive review of all FCA developments, but please contact the Volkov Law Group if you want to know more.

What Do The Government Statics Tell Us?

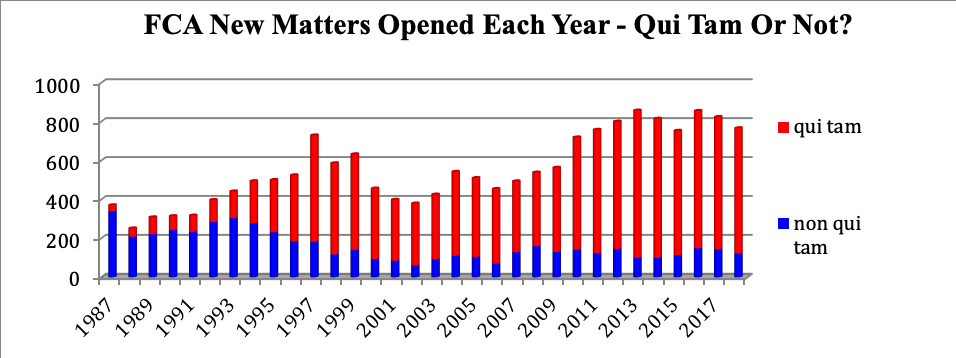

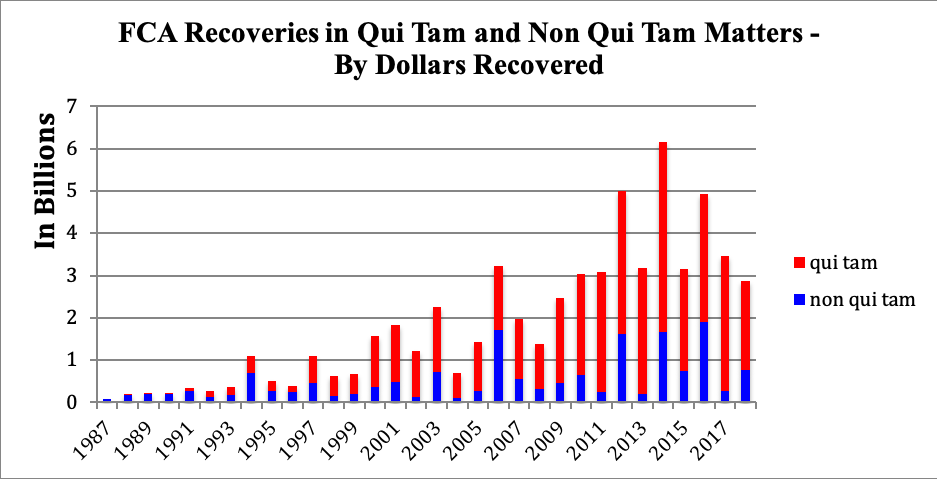

Whistleblowers: The government’s statistics start in October 1986, the month in which Congress enacted qui tam provisions, which allow individuals known as “relators” to file FCA civil actions on behalf of the government and share in the recovery. In1987, the government recovered roughly $86.5 million under the FCA, and, not surprisingly, none of those recoveries came from qui tam actions.

Since the passage of the qui tam provisions, however, relators have initiated the majority of FCA actions (71% of all new matters from 1987-2018), and government recoveries have skyrocketed. From 1986 through 2018, the government recovered just over $59 billion, with whistleblowers responsible for $42.5 billion (72%) of that recovery. In 2018 alone, whistleblowers initiated 84% of new matters and accounted for 73% of the government’s recoveries. Here’s what the numbers show us:

The above charts demonstrate that private individuals and entities have been the driving force behind civil FCA enforcement over the last several years, and there are no signs of such activity letting up. With strong whistleblower incentives (see below) and protections, we fully expect individuals and the plaintiffs’ bar to continue push FCA enforcement in 2019 and into the foreseeable future.

What does this mean for companies that do business with the government?

Now more than ever it is important to have robust compliance programs, with internal controls designed to prevent the submission of false claims and routine audits to detect any errors. Every good compliance program should include effective reporting mechanisms and swift responsive action following reports. If whistleblowers are truly motivated to do the right thing (and not simply looking to profit from an FCA claim), and feel they have a safe place to be heard and a satisfactory remedy, they may be less likely to initiate a qui tam action. And if entities that do business with the government receive internal reports of potential FCA violations, they may be able to swiftly stop potential misconduct, reduce potential damages and make an informed decision whether to self disclose. DOJ has repeatedly emphasized that companies trying to conduct ethical business, and which promptly disclose potential issues, may receive cooperation credit.

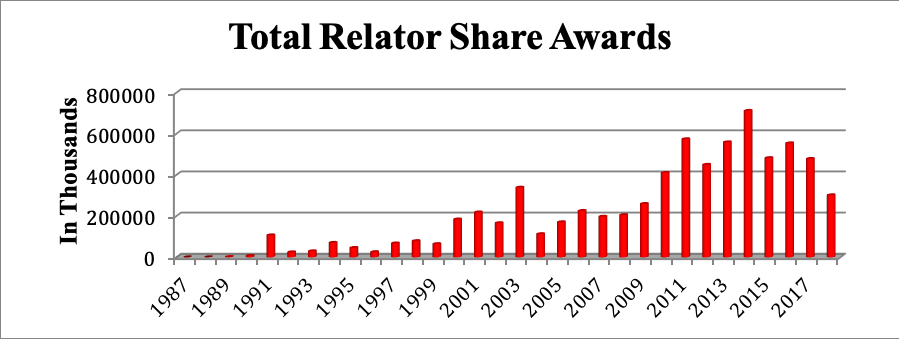

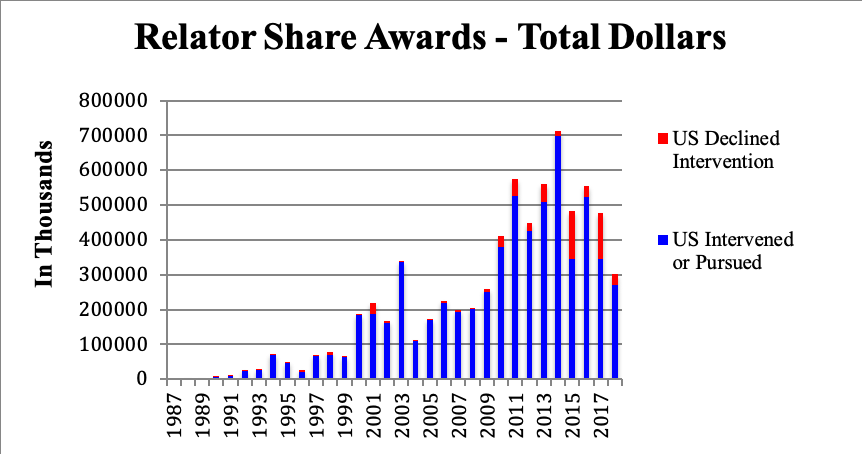

Incentives: Under the FCA, whistleblowers may receive up to 30% of any recovery. Since 1987, whistleblowers have received more than $7 billion in relator share awards. In 2018, relators received just over $301 million in awards. This figure is down significantly from 2017, however, and is the lowest number we have seen since 2009. Here’s what the numbers show us:

The above chart also shows that since in 2009 (when Congress expanded the scope of the FCA and augment whistleblower protections), whistleblowers recovered nearly $4.8 billion; in other words, the past 9 years – less than one third of the total time frame – account for more than two thirds of all relator share awards. It remains to be seen whether the slight downward trend since 2016 will continue or whether it will pick back up again.

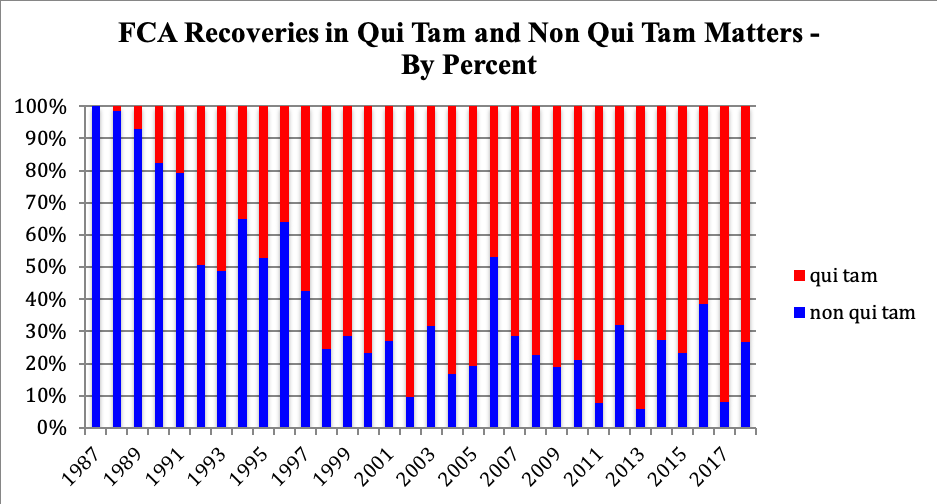

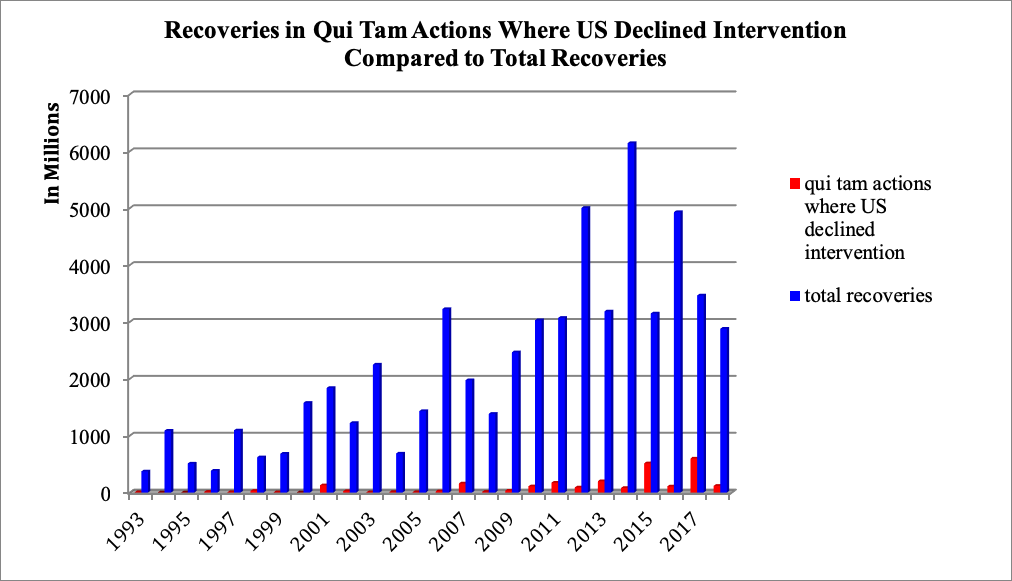

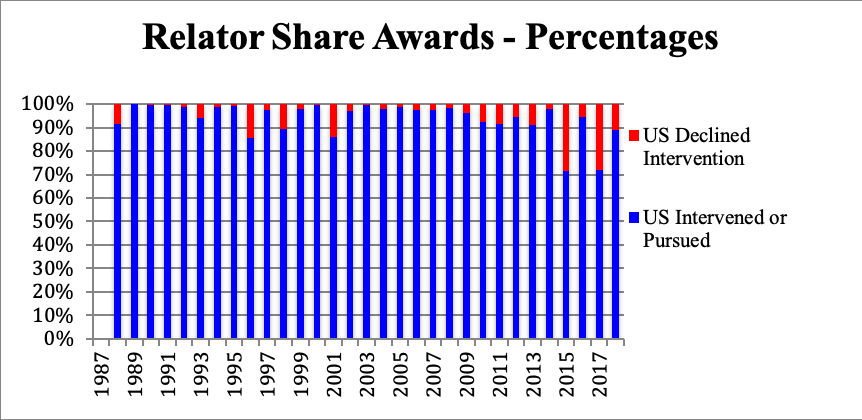

Intervention: Although whistleblowers initiate the vast majority of FCA cases, one thing is certain: government intervention is outcome determinative. The government as a whole recovers far more from cases in which it intervenes, and relator share awards are far greater when the government intervenes. Here’s what the numbers show us:

Recoveries: The first chart below begins in 1993, because that is the first year in which recoveries in cases where the government declined intervention exceeded 0% of total recoveries. In fact, recoveries in actions where the government does not intervene have never exceeded 17% of total annual recoveries (which was in 2017). In 2018, recoveries from qui tam cases in which the government declined intervention constituted only 4% of total recoveries, which is more consistent with prior years.

Relator Share Awards:

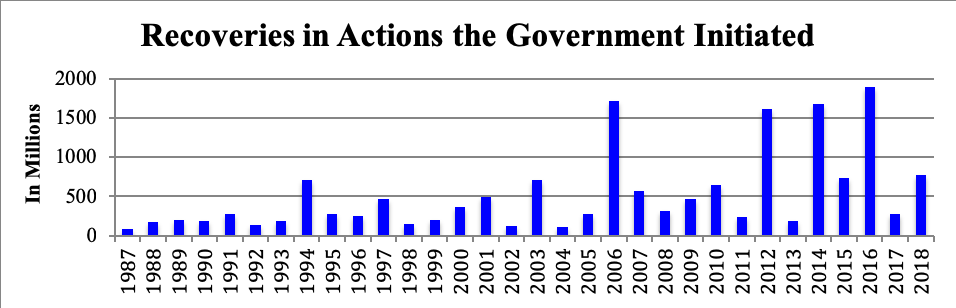

Government Action: Although the above charts show that whistleblowers initiate far more actions than the government, and that whistleblower actions account for the lion’s share of all settlements and judgments, the government also has been proactive in pursuing FCA violations. In the last five years alone, for example (from 2014-2018), the government initiated 630 new matters (an average of more than two new FCA matters per week), and the government recovered more than $5.3 billion in matters that it initiated. Recoveries of approximately $767 million in 2018 in cases that the government initiated represent an increase of more than $480 million from 2017, and are the fifth largest annual recoveries in such actions since 1987. Here’s what the numbers show us:

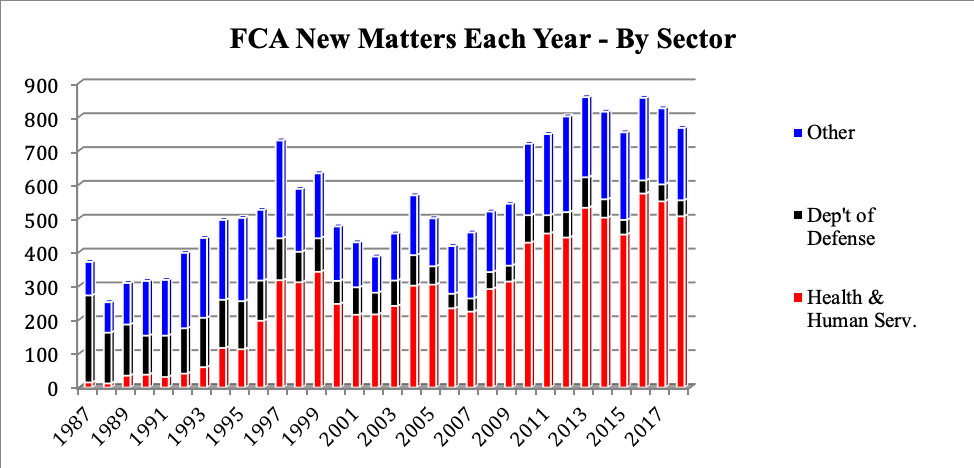

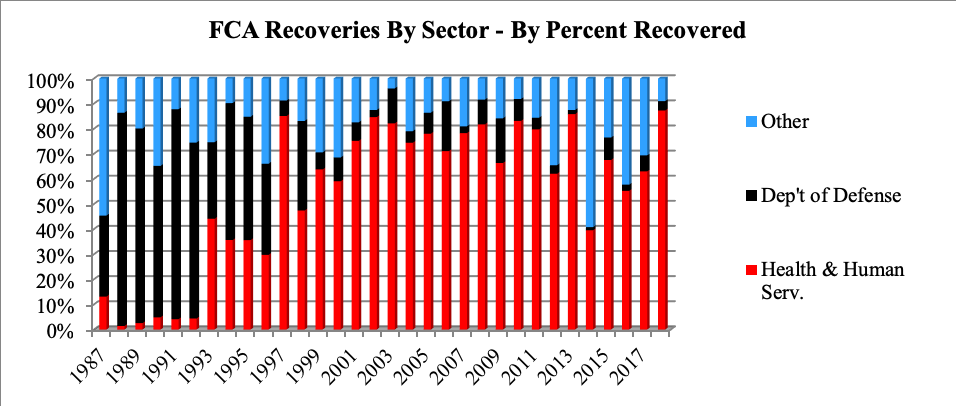

Sectors: All individuals and companies that do business with the federal government must be mindful of the FCA. The government’s statistics, however, are divided into three categories only: Health and Human Service, Department of Defense and “Other.” Here’s what the numbers show us about FCA activity by sector:

Healthcare: In 2018, healthcare recoveries accounted for the largest percentage of total annual recoveries (87%) since the government started keeping track of these figures. In fact, the government’s statistics show that most FCA recoveries in the last two decades have come from the healthcare sector. Within the sector, according to the DOJ press release accompanying its 2018 statistics, the largest recoveries in 2018 “came from the drug and medical device industry.”[3] DOJ highlighted the resolutions of qui tam cases against AmerisourceBergen Corporation and Alere, and the government’s cases against United Therapeutics Corporation and Pfizer.[4] DOJ added that it “continued to place great importance on enforcing the safeguards contained within the Anti-Kickback Statute.”[5]

We expect to see substantial FCA activity in the healthcare sector continue into the future, especially considering the incredible spending in this sector. With an aging baby-boom population and rising prices for medical goods and services, “national health spending [] projected to grow at an average rate of 5.5 percent per year for 2017-26 and to reach $5.7 trillion by 2026” (which includes an annual growth in spending for Medicare at 7.4% and an annual growth in spending for Medicaid of 5.8%.[6] DOJ has also signaled its intent to hold individuals accountable and to pursue criminal charges under appropriate circumstances.

Defense: FCA activity and recoveries in the defense sector may ramp up in 2019 as well. In fact, in November 2018 (part of fiscal year 2019), DOJ announced a $236 million settlement with three South Korean companies that resolved FCA and other violations stemming from bid rigging and price fixing of fuel supply services to the Department of Defense.[7] This single resolution in 2019 is more than twice the total amount recovered in the defense sector during 2018.

What’s Happening at DOJ?

At the start of 2018, two DOJ memos suggested that prosecutors might take a less aggressive stance towards FCA enforcement during the year. First, in a leaked memo known as the “Granston Memo,” the Director of the Commercial Litigation Branch, Fraud Section of DOJ’s Civil Division, directed prosecutors to more seriously consider dismissing cases filed under the FCA’s qui tam provisions.[8] Among other things, the Granston Memo reasoned that dismissal of whistleblower cases is “an important tool to advance the government’s interests, preserve limited resources, and avoid adverse precedent.”[9] Two weeks later, then Associate Attorney General Rachel Brand issued a memo to prosecutors essentially precluding the use of “noncompliance with guidance documents as a basis for proving violations,” including FCA violations.[10] Brand’s directive would apply, for example, to HHS, CMS, or OIG guidance. Brand emphasized the DOJ’s November 27, 2017, Guidance Policy from then Attorney General Sessions that prohibits the DOJ from using “noncompliance with guidance documents as a basis for proving violations.”[11] In February 2018, Deputy Associate Attorney General Stephen Cox confirmed, “we won’t be using noncompliance with a guidance document to prove a violation” of the FCA, and elaborated that DOJ is “focusing our limited resources on the most meritorious cases and the most legally viable theories.”[12] Cox even went as far as acknowledging the “obvious costs on defendants” of opposing meritless qui tam cases.[13]

In September 2018, in a long-awaited, updated “Justice Manual,”[14] the DOJ officially incorporated much of the substance of the Ganston and Brand Memos. For example, the Justice Manual, like the Brand Memo, provides “[c]riminal and civil enforcement actions brought by the Department must be based on violations of applicable legal requirements, not mere noncompliance with guidance documents issued by federal agencies.”[15] And the Justice Manual, like the Granston Memo, provides a non-exhaustive list of factors that can serve as a basis for dismissal of qui tam actions and repeats “dismissals also provide an important tool to advance the government’s interests, preserve limited resources, and avoid adverse precedent.”[16]

It is still a bit too soon to tell whether these policy statements will result in a tangible change in FCA enforcement, and the 2018 statistics discussed above do not reveal much in this regard (largely because FCA matters typically take more than one year to investigate and resolve). By the end of 2018, however, the DOJ had followed through in at least two significant ways.

First, in an Amicus Curiae brief filed in the Supreme Court on November 30, 2018, the DOJ stated it had “determined that, if this case is remanded to the district court, the government will move to dismiss” the action based on some of the factors listed in the Granston Memo and the Justice Manual.[17] Second, in United States ex rel. Health Choice Group, LLC v. Bayer Corp, DOJ moved to dismiss a qui tam case pending in the Eastern District of Texas (and signaled its intent to move to dismiss ten similar qui tam actions in different judicial districts), brought by the same “professional relator” against multiple defendants.[18] Clearly the government determined that the case lacked merit and risked draining precious governmental resources. But the DOJ also seemed to express disdain for “a limited liability company established for the sole purpose of serving as the named relator” that was “set up by investors and former Wall Street investment bankers.”[19] The relator viewed FCA claims as a “massive business opportunity,” and gathered evidence under the “false pretense” that it was conducting a “research study.”[20] The defense bar has long protested that FCA whistleblowing has become a lucrative business for repeat professional relators and others who bring meritless claims leveraging the threat of defense costs and treble damages and per claim penalties. An increased willingness by the DOJ to intervene and dismiss meritless cases would be a welcomed relief. On that note, current Attorney General nominee William Barr once agreed: he thought the qui tam provisions were “basically a bounty hunter statute . . . an abomination . . . [he] wanted to attack.”[21] But just days ago, during a Senate Judiciary Committee hearing on his nomination, Mr. Barr stated he no longer believes the FCA is an abomination and committed to “diligently uphold” the FCA.[22]

The Volkov Law Group will continue to

monitor this area and post important FCA developments on our blogs. As always,

if you have any questions, please feel free to contact any one of our

attorneys.

[1] Department of Justice Fraud Statistics (available at https://www.justice.gov/civil/page/file/1080696/download?utm_medium=email&utm_source=govdelivery. All graphics in this article are derived from these statistics.

[2] The federal government’s fiscal year is October 1 – September 30. Unless stated otherwise, references to years in this article are to the government’s fiscal year.

[3] DOJ Press Release No. 18-1690, Justice Department Recovers Over $2.8 Billion from False Claims Act Cases in Fiscal Year 2018 (Dec. 21, 2018), available at https://www.justice.gov/opa/pr/justice-department-recovers-over-28-billion-false-claims-act-cases-fiscal-year-2018.

[4] Id.

[5] Id.

[6] Office of the Actuary, Centers for Medicare & Medicaid Services, National Health Expenditure Projections 2017-2026, available at https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/Downloads/ForecastSummary.pdf.

[7] DOJ Press Release No. 18-1503, Three South Korean Companies Agree to Plead Guilty and to Enter Into Civil Settlements for Rigging Bids on United States Department of Defense Fuel Supply Contracts (Nov. 14, 2018), available at https://www.justice.gov/opa/pr/three-south-korean-companies-agree-plead-guilty-and-enter-civil-settlements-rigging-bids.

[8] Memo, U.S. Dep’t of Justice, Factors for Evaluating Dismissal Pursuant to 31 U.S.C. 3730(c)(2)(A) (Jan. 10, 2018), available at https://assets.documentcloud.org/documents/4358602/Memo-for-Evaluating-Dismissal-Pursuant-to-31-U-S.pdf.

[9] Id.

[10] Memo, Limiting Use of Agency Guidance Documents in Affirmative Civil Enforcement Cases (Jan. 25, 2018), available at https://www.justice.gov/file/1028756/download.

[11] Id.

[12] Deputy Associate Attorney General Stephen Cox Delivers Remarks at the Federal Bar Association Qui Tam Conference, available at https://www.justice.gov/opa/speech/deputy-associate-attorney-general-stephen-cox-delivers-remarks-federal-bar-association.

[13] Id.

[14] Justice Manual, available at https://www.justice.gov/jm/justice-manual.

[15] Id. at 1-20.100.

[16] Id. at 4-4.111.

[17] Gilead Sciences, Inc. v. United States ex rel. Campie, No. 17-936, brief available at https://www.justice.gov/sites/default/files/briefs/2018/12/21/17-936_gilead_sciences_ac_pet.10.pdf.

[18] United States ex rel. Health Choice Group, LLC v. Bayer Corp, Case 5:17-cv-00126-RWS-CMC, Dkt. No.116 (Dec. 17, 2018), available at https://www.laborandemploymentlawcounsel.com/wp-content/uploads/sites/224/2018/12/US-Motion-to-Dismiss-Health-Choice-Advocates-v-Gilead-Sciences-ED-Tx-12-17-18.pdf.

[19] Id., see also J.C. Herz, “Medicare Scammers Steal $60 Billion A Year. This Man Is Hunting Them” (Wired, March 2016), available at https://www.wired.com/2016/03/john-mininno-medicare/.

[20] United States ex rel. Health Choice Group, LLC v. Bayer Corp, Case 5:17-cv-00126-RWS-CMC, Dkt. No.116 (Dec. 17, 2018).

[21] The Miller Center, Presidential Oral Histories, George H.W. Bush Presidency, Transcript of Interview with William P. Barr (April 5, 2001), available at https://millercenter.org/the-presidency/presidential-oral-histories/william-p-barr-oral-history-assistant-attorney-general.

[22] See Tinker Ready, “Attorney General nominee Barr commits to ‘diligently uphold’ the False Claims Act,” (Jan. 15, 2019), available at https://www.whistleblowersblog.org/2019/01/articles/false-claims-qui-tam/barr-to-uphold-fca/.