FCPA Predictions for 2020 (Part III of III)

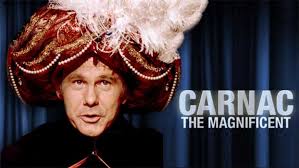

It is time to break out the crystal ball for FCPA 2020 Predictions. In preparing for this, I always rely on my past admiration of Carnac the Magnificent (see here and here for a couple of examples).

There are some trends that are becoming more reliable to “predict” or just observe. DOJ is steadily adhering to the principles outlined in its FCPA Corporate Enforcement Policy. There will always be some disagreement among practitioners as to the “appropriate” resolution under the Policy, but DOJ deserves credit for its crafting and adherence to the Policy. The Policy provides a fairly predictable set of factors and expectations surrounding enforcement, disclosure and cooperation.

One prediction (which has already been disclosed) is that Goldman Sachs will enter into a record-setting FCPA settlement for $2 billion (with a B) for FCPA violations related to the 1MDB scandal in Malaysia. Goldman Sachs deserves to be punished for its involvement in this notorious scheme and several individuals are likely to be prosecuted in addition to those already under indictment. So, we all begin with one “correct” prediction likely to occur early in 2020.

Aside from the Goldman case, 2020 is likely to be another record year in criminal prosecution of individuals. DOJ prosecuted 26 individuals in 2018 and 34 individuals in 2019. Given its ongoing and active investigations surrounding PDVSA and related cases involving Venezuelan officials, I would expect these parallel investigations in New York, Miami and Houston to continue to prosecute a significant number of individuals. In addition, some of the large corporate enforcement actions in 2019 may bear fruit with individual prosecutions. In sum, I am predicting that DOJ will prosecute at least 45 individuals in 2020, continuing its steady increase and focus on individual prosecutions.

On the corporate enforcement side, DOJ and the SEC will easily surpass 2019 given the expected $2 billion Goldman Sachs enforcement action. DOJ and the SEC have several ongoing investigations involving significant corporate actors including Herbalife for its conduct in China; Maersk for its Brazil bribery activities involving Petrobras; and Honeywell for its Brazil bribery scheme involving Petrobras.

In the healthcare industry, we can expect a focus on an ongoing investigation against Siemens, Phillips and GE for their participation in bribery schemes involving medical devices in China and Brazil.

Another significant issue to consider is the implications of the 2019 guilty pleas by three Unaoil officials. Given the number of oil and gas companies that conducted business with Unaoil over the last ten years, we are likely to see a resurgence of enforcement actions against oil and gas companies. A simple list of the countries and companies involved in these business activities reveals a significant number of companies that may be subject to FCPA scrutiny.

2019 was a significant enforcement year against telecommunications companies – Ericsson and MTS being the two largest enforcement actions. While much of the conduct in these cases focused on Uzbekistan, the telecommunications industry, like oil and gas and mining industries, involves significant risks from interaction with foreign government officials, especially when it comes to licensing activities and upgrades to new technologies such as 5G. For that reason, telecommunications companies may be at greater risk for FCPA enforcement. This is a trend that should be watched.