The Dangerous Mix of Incentives and “Misconduct”

We often hear about the dangerous risk to a company’s culture from rigorous sales incentive programs. Like most issues, the answer to this issue is not cut and dried.

On the one hand, we have a glaring example of failure – the Wells Fargo case. Financial sales staff were subjected to an incredible sales program – for each client, a sales employee was required to sell eight separate products. This sales incentive program had a disastrous impact that was compounded by the enforcement of this requirement and berating by managers of sales staff who failed to meet this standard. A large number of sales staff were fired for failing to meet this standard.

The Wells Fargo debacle lead to employee misconduct as many employees created false accounts, ordered credit cards and other products without any customer authorization, and engaged in massive misconduct. As time went on, employees started to complain about the program, misconduct rates soared, and Wells Fargo’s culture deteriorated. Employees who reported problems were fired and themessage throughout the company was clear – meet the sales requirements and keep your mouth shut.

Eventually, Wells Fargo made a deal with the devil – choosing increased profits from an unreasonable sales incentive program over a culture of compliance and a culture committed to reducing misconduct by supporting a speak up program and investigation of employee concerns.

Wells Fargo is an extreme example where an egregious sales incentive program was compounded by a commitment to profits without any regard for ethics and compliance.

But the Wells Fargo history contains important lessons surrounding sales incentive programs. By definition, sales incentive programs for employees are not wrong – rather, a sales incentive program has to be carefully crafted to weigh specific incentives and risks, and include rigorous controls to minimize risk of misconduct by sales employees to meet a sales incentive standard.

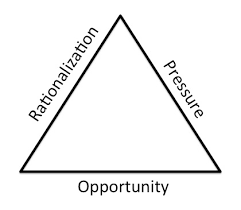

Many companies include monthly, quarterly or and/or annual standards that define bonus payments, increase in salaries and/or promotional opportunities. Sales activities that occurs near a deadline are inherently risky and subject to manipulation or potential misconduct. To meet a standard, a sales employee may secure a bribe or make a promise of a bribe to close a deal. Additionally, a sales person may engage in channel stuffing activities to meet a required sales number or reach an incentive measure. In these situations, companies have to adopt controls to review such activity, require increased documentation during the sales process, and supervisory scrutiny and approvals.

Some companies have adopted sales incentive programs that apply to teams or specific sales groups – the risk of misconduct may be lower because it requires coordination of an improper scheme among a group of sales employees. Such a requirement may reduce potential misconduct and increase the risk that an employee may report the misconduct.

Aside from the careful design of a sales program, a company has to adopt and implement important surrounding controls that address review and approval of any sales contract by supervisors, and financial and compliance staff.

Just as important, companies have to encourage employee reporting, prompt investigation of potential misconduct, and compliance communications from senior leadership and sales managers that employee misconduct to meet sales incentive programs will not be tolerated and strict discipline will be imposed when such misconduct occurs.