The CARES Act and DOJ Prosecution of Fraud

When Congress enacts massive financial relief legislation, one inevitable result is fraud, waste and abuse. Going back to the financial crisis in 2008, DOJ had a trove of criminal fraud and civil fraud cases under the False Claims Act.

With the passage of the CARES Act, you can count on DOJ ramping up criminal and civil fraud prosecutions, especially under the False Claims Act. The CARES Act allocates roughly $2 trillion for financial relief in various industries. The bulk of the money will be made available through Federal Reserve loan programs designed to provide relief to specific industries.

Section 4108 of the CARES Act establishes a Special Inspector General for pandemic recovery in the Department of Treasury. The new Special Inspector General is a Presidential appointee, subject to Senate approval. The nomination must be made on “the basis of integrity and demonstrated ability in accounting, auditing, financial analysis, law, management analysis, public administration, or investigations.”

The scope of the Special Inspector General’s remit is not just the Treasury Department’s conduct but extends to proper use and grant of funds to beneficiaries. In other words, the Special inspector General will have authority to investigate and refer prosecutions to DOJ focused on fraudulent use of CARES Act funds.

The CARES Act described one of the Special Inspector General’s duties to include “the making, purchase, management, and sale of loans, loan guarantees, and other investments made by the Secretary of the Treasury under any program.” To enable such investigations, Congress gave the Special Inspector General subpoena power. Such subpoena power includes the right to subpoena information from third parties. In sum, the new Special Inspector General will exercise expansive powers covering a broad range of conduct involving the sale of loans, loan guarantees and other investments under the CARES Act.

To avoid claims of political favoritism or ineffective supervision, DOJ will have to aggressively enforce fraud laws and specifically the False Claims Act, its strongest tool in the battle against fraud, waste and abuse. Like the Inspector General created to monitor the Troubled Asset Recovery Program created during the 2008 financial crisis, the CARES Act Special Inspector General can be expected to refer criminal and civil cases to the Justice Department and specific US Attorneys’ Offices.

DOJ touts each year the success of its False Claims Act enforcement program, citing annual total recoveries in the $3 billion range. With the addition of the new CARES Act Special Inspector General, it is likely that DOJ will exceed these annual totals as its enforcement program incorporates fraud schemes and abuse with CARES Act funding, loans and loan guarantees.

DOJ has focused most of its False Claims Act prosecutions in the healthcare industry and a smaller percentage against defense contractors. The CARES Act Special Inspector General is likely to find fraud in a broad range of industries that may benefit from loans, loan guarantees or other programs.

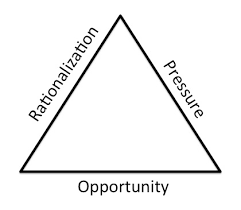

It is important to watch this trend. As the federal government makes large sums of money available, fraud increases because of greed and grifters who inevitable come out of the woodwork seeking money for illegitimate purposes.

Given the controversies surrounding the 2008 financial bailout, DOJ will act aggressively to blunt any criticism by prosecuting fraudsters. Congress is preparing to conduct oversight of the CARES Act to ensure proper use of the funds. The CARES Act Special Inspector General and DOJ will be in Congress’ cross-hairs for scrutiny given the massive amount of money and the risk of fraud.