Unraveling Beneficial Ownership Risks (Part II of IV)

When discussing the importance of beneficial ownership with compliance professionals, there is often a disconnect between the theory and reality. Everyone understands the legal and compliance risks and how they apply to third-parties, vendors and suppliers. But when a compliance officer considers the burden of uncovering beneficial ownership interests, they quickly resist the need for such an analyses across the population. And for good reason.

Assume that a company has a third-party, vendor and supplier population of 80,000 or more – a reasonable number for a mid-sized global company. Now, add to this list, the number of customers the company has – another 20,000 or so, and you have a total population of 100,000 that needs to be subject to beneficial ownership disclosure.

OFAC sanctions regulations apply to all company transactions. Companies are prohibited from dealing with SDN customers, whether they are on the SDN list or they are owned 50 percent or more by one or more SDNs. Obviously, the implications of such a requirement are significant.

To complicate matters more, an anti-corruption risk analysis relating to a vendor/supplier turns on two specific issues:

First, whether the entity (or person) serves in a “representative capacity” for the company. In other words, third-parties, vendors or suppliers that do not interact with foreign government interests on your company’s behalf do not create potential bribery.

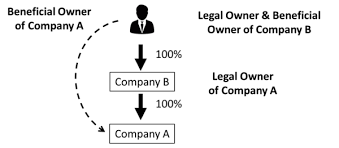

Second, whether the entity includes or is closely connected to a foreign government official’s ownership interest. In assessing this risk, a company has to examine whether the third-party has a foreign government ownership interest or whether such an interest is held by a close family member to the foreign government official.

In Situation 1 or 2, the risk of bribery is evident by the representative relationship or the direct government ownership interest in the third-party, vendor or supplier.

In the first situation, it is critical to examine the nature and scope of interactions that the third party, vendor or supplier will have on the company’s behalf with the foreign government. We are all familiar with the range of interactions, including government tenders and contracts, regulatory functions such as health and safety, tax, labor, immigration visas and customs.

In the second situation, companies have to identify the specific ownership interest, drill down to all the natural persons owners of the company. If a government official owns a partial interest in the vendor/supplier, the company has to examine the role of the government owner in the company’s business, i.e. does the government official have a role in the government that he/she could leverage to benefit the company?

If the government official serves in the state-owned oil and gas company, and the potential third-party provides oil and gas services, then the partial owner certainly could leverage his/her position to favor the vendor/supplier and increases bribery risks. Such a case is a show stopper – but there are many other types of cases, where the government official has a remote connection to the vendor/supplier’s business.

The FCPA Guidance from 2012 includes a specific hypothetical to address this issue and outlines a strategic approach to permit engaging a third-party with a foreign government official owner.