The New York Attorney General’s Office Reaches Settlement with Bitfinex and Tether

Matt Stankiewicz, Managing Counsel at The Volkov Law Group, joins us for updates on the NYAG’s case against Bitfinex and Tether. Matt can be contacted at [email protected].

In late February, the New York Attorney General’s office (“NYAG”) settled with Bitfinex and Tether stemming from charges relating to financial mismanagement. The NYAG alleged that Bitfinex and Tether attempted to cover up the loss of approximately $850 million in customer funds. Additionally, the NYAG alleged that Tether misrepresented that its stablecoin maintained adequate reserves of one US dollar for every one Tether coin. As part of the settlement, Bitfinex and Tether agreed to pay $18.5 million, cease trading with New York residents and entities, and will provide quarterly transparency reports to the NYAG. As part of the settlement, Bitfinex and Tether neither admit or deny any of the NYAG’s findings.

In a statement, New York Attorney General Leticia James declared:

Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie. These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.

Bitfinex is a cryptocurrency exchange that allows its users to trade a wide range of virtual currencies, along with a variety of related services. Tether is a stablecoin pegged to the US dollar, trading under the acronym USDT. The two companies are closely intertwined, sharing several directors and executives. This investigation revealed that funds were also frequently commingled between the two.

Tether specifically represents that it maintains a corresponding level of reserves so that one tether is always backed by one US dollar. A stablecoin in general is a cryptocurrency designed to maintain its value despite the volatility in the cryptomarkets at large. Stablecoins are important for cryptocurrency traders. It allows traders to keep money in the cryptocurrency ecosystem while moving between trades, and also allows for a “safe haven” to park funds in the event of downward market volatility.

Tether’s Reserve Troubles

Throughout the early years of tether, the company maintained a banking relationship with several Taiwanese banks, with Wells Fargo acting as the correspondent bank. In March 2017, Wells Fargo declined to process any further US dollar wire transfers, which forced Tether to find a new banking partner. At this point, there were approximately 51 million Tether in circulation, and the company continued to “print” new tether at a rapid pace. By the end of May 2017, the amount of tether in circulation had more than doubled to over 108 million.

Despite this, Tether had still not managed to find a new banking partner. In fact, Tether did not have any sort of significant banking relationship until September 2017. During this gap, Tether maintained much of its funds at the Bank of Montreal under its General Counsel’s name. Despite the increase in Tether on the market, this account never held more than $61.5 million. Regardless, Tether continued to “print” new coins during this period, reaching approximately 442 million Tether on the market in September 2017. On the other hand, Bitfinex represented to the NYAG that it held approximately $382 million of Tether’s funds at this point in what appeared to be, at best, a commingled bank account with a Puerto Rican bank. Tether accounted for these funds by booking a “receivable” from Bitfinex.

During this time frame, rumors circulated throughout the market that Tether did not have ample reserves to support its continued printing. In June 2017, Tether engaged Friedman LLP to conduct an audit of its reserves. The audit was never completed. In September, instead of an audit, Tether and Bitfinex request that Friedman LLP perform an independent verification that Tether maintained adequate reserve funds. On the morning of September 15, 2017, Bitfinex transferred nearly $382 million from its own bank account, into an account in Tether’s name. Later that day, Friedman LLP verified that Tether had approximately $442 million between this new account and the account at the Bank of Montreal. Tether posted this misleading verification as a “Transparency Update” on its website.

Bitfinex’s Banking Troubles

Bitfinex allowed users to exchange fiat currency (e.g., US dollars, Euros, etc.) for virtual currency, and vice versa. In order to do so, Bitfinex relied on third party payment processors to facilitate the deposits and withdrawals. During 2017 and 2018, it was a difficult task to find banks willing to take on these activities as they were considered extremely risky, unsurprisingly. As such, Bitfinex relied on Crypto Capital Corp., a Panama-based institution, to process deposits and withdrawals for its users. By May 2018, Crypto Capital held over $1 billion in funds from Bitfinex users.

In April 2018, reports began to surface that Crypto Capital was having regulatory issues and countries had begun to freeze its assets. Poland was one of the first, freezing approximately $340 million in funds. When Bitfinex inquired, Crypto Capital assured the exchange that the freeze was temporary. Over the course of several months, Crypto Capital provided various excuses for its inability to return funds to Bitfinex. Portugal subsequently froze an additional $150 million of Crypto Capital’s assets. Bitfinex began to internally discuss strategies to weather a “temporary liquidity crisis,” as they coined it, but continued to utilize Crypto Capital despite its issues.

To address the “temporary liquidity crisis,” Bitfinex “borrowed” $400 million from Tether by transferring the money from Tether’s bank account to its own bank account. Bitfinex also directed Crypto Capital to transfer funds between its Bitfinex account and Tether account at Crypto Capital – effectively, if the money was frozen with Crypto Capital, at least Bitfinex could move it around there to finagle its internal books. During this time, reports began to surface that Bitfinex was insolvent. Bitfinex denied the allegations.

On November 1, 2018, Tether announced a partnership with a new bank in the Bahamas, Deltec Bank and Trust Ltd. With that announcement, Tether publicized a letter from the bank that stated Tether’s account maintained a value of $1,831,322,828, which was equal to the amount of Tether currently on the market. The next day following the announcement, Tether moved almost $500 million in funds to Bitfinex’s account. Bitfinex also “purchased” nearly $150 million in Tether. Merely a day after Deltec’s representations, Tether was no longer truly backed one to one.

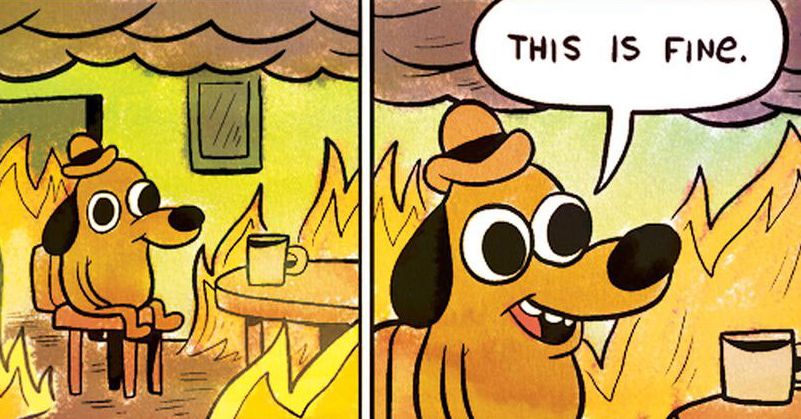

Throughout November 2018, Bitfinex demanded Crypto Capital release its funds. Communications provided to the NYAG indicate that Bitfinex complained to Crypto Capital that they failed to produce “even 1 usd for the whole month.” Records indicate that Bitfinex may have had upwards of $860 million in funds tied up with Crypto Capital throughout this period. To further address the liquidity crisis caused by the frozen funds, in March 2019 Bitfinex negotiated a line of credit that allowed it to draw up to $900 million from Tether’s reserves. Despite the financial finagling, Bitfinex apparently struggled to fulfill withdrawal requests for its customers during this time period. Yet with all that was happening behind the scenes, both Bitfinex and Tether continued to publicly state that everything was fine and under control.

As of the date of the settlement, Bitfinex apparently has still not been able to access its funds at Crypto Capital and cannot provide any evidence it will be able to access them in the near future. As of the posting of this article, the supply of Tether exceeds $38 billion.