A Kinship with Sisyphus: Challenging an OFAC SDN Designation

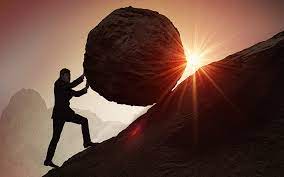

There are lots of life lessons to apply from Greek Mythology. The classic character Sisyphus, who was punished by Zeus for his trickery and condemned for eternity to push a large boulder up a hill, reminds us of the consequences of punishment and the frustration from repetitive failure.

How does this apply to trade sanctions compliance? Bear with me here as I make the leap – The Treasury Department’s Office of Foreign Asset Control (“OFAC”) has an established procedure for designation of Specially Designated Nationals (“SDNs”). Under applicable regulations, U.S. persons (and other certain categories of individuals in the United States) are prohibited from a large range of business transactions and interactions, while freezing assets under the control of SDNs in various contexts. It is a tool that has enormous consequences to individuals, businesses and organizations.

Once designated, some entities may challenge OFAC’s action. In other contexts, when the immediacy or rationale may change, entities may be removed from the SDN list. Entities and individuals who challenge the SDN designation rarely succeed – in fact, I would estimate that removing the SDN designation is unlikely and often not worth the effort.

In a recent lawsuit filed in the U.S District Court for the District of Columbia, Strait Shipbrokers and its managing director, Murtuza Mustafa Munir Basrai (“Basrai”), challenged its SDN listing. The last administration designated Strait Shipbrokers and Basrai based on its involvement in the transport of oil from Iran.

Strait Shipbrokers claimed that it was not required to check the origin of its cargo as a broker and that the designation violated the Administrative Procedure Act.

The lawsuit highlights the financial impact of an SDN designation. Strait Shipbrokers claimed that the SDN listing has placed it in a “dire financial situation,” resulting in the freezing of its Citibank account in Singapore, the cancellation of its insurance and damages to its financial relationship with various U.S. companies. As a consequence, Strait Shipbrokers has had to terminate 33 employees.

Strait Shipbrokers claims that OFAC did not provide adequate disclosure of OFAC’s basis for its SDN designation, which was largely based on classified information and not subject to disclosure requirements. By seeking an immediate injunction, Strait Shipbrokers is seeking to have the district court review the designation. In a recent decision, the district court rejected Strait Shipbroker’s request.

Strait Shipbroker argued that it did not “knowingly” engage in transactions involving Iran oil products, claiming that they act only as intermediaries between ship owners and charter parties and have limited visibility into the underlying charter transactions. The trial judge noted that the requisite standard of intent includes circumstances where a person “should have known” about the relevant conduct, circumstances ore result. In applying that standard, the trial court noted that if Strait Shipbroker exercised “willful blindness” to the cargo origin or destination, such lack of knowledge cannot protect them for responsibility for the transaction.

In rejecting Strait Shipbroker’s due process and violation of the APA claims, the trial judge noted that OFAC was not required to provide pre-designation notice of its intent to add Strait Shipbroker to the SDN list – affording them a post-designation process for challenging the designation was adequate.

Given the importance of OFAC trade sanctions to United States foreign policy objectives, the trial judge was reluctant to enjoin the SDN designation, at this stage of the proceedings. OFAC is afforded significant deference when acting to restrict business activities that undermine U.S. foreign policy objectives.