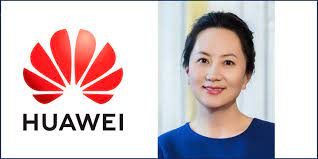

DOJ Ends Standoff & Agrees to DPA with Huawei CFO Wanzhou Meng

The long political and prosecution standoff between the U.S. Government/Department of Justice and Huawei/China ended abruptly last week when Wanzhou Meng, CFO of Huawei Technologies Co., Ltd. appeared in federal district court in Brooklyn and entered into a deferred prosecution agreement (DPA) and admitted to misleading global financial institutions. Meng was immediately released and returned to China.

The resolution of Wanzhou Meng’s case resolved a major point of contention between China and the United States. Shortly after announcement of the resolution of Meng’s case, China released two Canadians who were arrested shortly after Meng was taken into custody in December 2018.

China objected to the arrest of Wanzhou Meng and potential extradition by Canada to the United States. The disagreement had stalled extradition of Wanzhou Meng for over two years while she was detained in Canada.

Meng was arrested at Vancouver Airport on a United States warrant after her indictment in the United States on bank and wire fraud charges for misleading HSBC in 2013 about Huawei’s business dealings in Iran.

The DPA applies only to Meng and the Justice Department is scheduled to continue its prosecution of Huawei in federal court in Brooklyn.

As part of the DPA, Meng agreed to a statement of facts in which she took responsibility for her role in perpetrating a scheme to defraud HSBC. In particular, Meng made several material misrepresentations to an HSBC executive regarding Huawei’s business operations in Iran. Her misleading statements were intended to maintain Huawei’s banking relationship with HSBC.

As set forth in the statement of facts, Skycom Tech. Co., was a hong Kong company that operated in Iran. As of February 2007, Skycom was a wholly-owned subsidiary of Huawei and Hua Ying Management. In November 2007, Hua Ying transferred its shares to another entity that Huawei controlled, Canicula Holdings. At this time, Meng was the Secretary of Hua Ying.

In February 2008, Meng joined Skycom’s Board of Directors, which consisted of Huawei employees. Meng stayed on the board until April 2009. After she departed, Skycom’s board continued to be controlled by Huawei employees, Canicula was controlled to own Skycom and Canicula remained under Huawei’s control. As of August 2021, Skycom was listed as a Huawei subsidiary in its corporate documents. All significant Skycome decisions were made by Huawei.

Huawei employees engaged a U.K. staffing company to provide engineers to support Skycom’s work in Iran. Huawei paid for these services by sending around $8 million in U.S. dollars from Skycom’s bank accounts in Asia.

In late 2012 and early 2013, news organizations reported that Skycom was selling “embargoed” equipment from a U.S. computer equipment manufacturer in Iran in violation of U.S. export control laws. Huawei denied any ownership interest in Skycom and claimed that it was a local partner in Iran. Huawei claimed that it was in full compliance with U.S., E.U. and U.N. trade compliance laws.

In a 2013 article, it was reported that Meng served on the Skycom board and identified other connections between Skycom directors and Huawei. After this report, HSBC and other global banks that previously provided international banking services to Huawei, including U.S. dollar transactions, directed inquiries to Huawei concerning these reports. In early 2013, a Huawei representative repeated its representation that Skycom was just a local partner in Iran.

In a presentation made to HSBC in Hong Kong in 2013, Meng represented that Skycom was a business partner of Huawei and a third-party Huawei “works with” in Iran. These statements were false. Meng knew that Skycom was controlled by Huawei employees and that Skycom employees were Huawei employees. Meng further falsely claimed that Huawei was once a shareholder of Skycom, when in fact Huawei had sold its shares to Canicula that Huawei controlled.

Between 2010 and 2014, Huawei caused Skycom to conduct approximately $100 million worth of illegal U.S.-dollar transactions through HSBC which violated U.S. OFAC sanctions against Iran.