Joseph R. Biden, Jr. —The Anti-Corruption President?

Alex Cotoia, Regulatory Manager at The Volkov Law Group, rejoins us for a posting on the Biden Administration’s Memorandum designating the fight against corruption as a national security interest. Alex can be reached at [email protected].

Scores of articles and volumes of commentary have been issued since President Joseph R. Biden, Jr. issued a presidential memorandum (hereinafter, “Memorandum”) making global anticorruption efforts an urgent national security priority of the United States. Completely absent from most of such commentary, however, are practical considerations for businesses which are now faced with diverting their scare resources—including human capital, compliance budgets, and executive attention—to match the Administration’s ambitious effort to ferret out corruption both domestically and internationally. The chief objective of this blog post is to provide clear, definitive guidance to companies operating in markets that pose an elevated corruption risk. Before doing so, however, some background information about the Administration’s effort is provided for those unfamiliar with the Memorandum itself.

A Brief Background

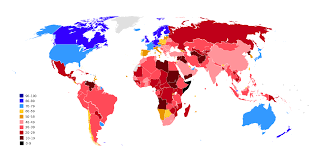

Signed by President Biden on June 3, 2021, the Memorandum focuses on corruption as corrosive of public trust, distortive of global markets, and undermining the stability of democratic regimes. The Memorandum notes, for instance, that the cost of corruption “saps” between 2 and 5 percent from global gross domestic product. Contributing to the situation are “anonymous shell companies, opaque financial systems, and “professional services providers” well trained in the art of laundering ill-gotten proceeds into what appears to be legitimate wealth. More fundamentally, the Memorandum states that corruption directly threatens both the national security and economic policy interests of the United States itself. Corruption also impedes the ability of the United States and other industrialized nations to combat poverty and promote development efforts in emerging markets.

The Memorandum therefore directs an “interagency review” to be spearheaded by the President’s National Security Advisor, Economic Policy Advisor, and Domestic Policy Advisor. The goal of such a review is to propose a “Presidential strategy” designed to bolster the United States government’s capability to promote good governance, prevent and combat corruption, counter illicit finance, improve the capacity of domestic and international institutions and multilateral bodies to establish global anti-corruption norms, and work with global partners to counteract “strategic corruption” by foreign leaders, including foreign state-owned or affiliated enterprises and transnational criminal organizations—among other things.

Included in the interagency review process to be conducted by members of the Executive Office of the President are key cabinet departments and officials, sub-cabinet level agencies, and the Office of the Vice President. Ambitiously, the deadline for completion of the review is scheduled for the end of the calendar year, or December 20, 2021.

The Biden Administration’s focus on combatting corruption on a global scale seems to be the fulfillment of a pledge then-candidate Biden made as a contender for the Presidency. Throughout the 2020 campaign, Biden and his team repeatedly emphasized his intention to be the virtual antithesis of his predecessor by focusing on issues like conflicts of interest and “ending the practice of anonymous shell companies.” In conjunction with the Administration’s focus on full transparency within the cryptocurrency market, the focus on global corruption is part and parcel of President Biden’s good government initiative.

Practical Considerations

Businesses across all economic sectors should take note of the Administration’s laser-like focus on anti-bribery and corruption (“ABAC”) issues. For organizations with established ABAC policies and procedures, the calm before the proverbial storm (i.e., the formal adoption of the final interagency report) presents an opportunity to assess the effectiveness of the organization’s internal controls, update due diligence of any third-parties or representatives with which the organization contracts in known corruption ‘hot spots,’ and re-articulate the organization’s commitment at the executive level to zero tolerance for bribery or corruption activities of any sort.

For organizations that lack a formal ABAC program—of which there are still far too many—now is the time to act swiftly to implement appropriate policies, procedures, training, and communications to inculcate the notion that bribery has no place in the operations of the organization. As a start, organizations that meet this criterion should utilize the U.S. Department of Justice’s updated 2020 Guidelines on the Evaluation of Corporate Compliance Programs (“DOJ Guidelines”) as a benchmark. In particular, these organizations should construct their compliance program around the three fundamental questions posed by the DOJ Guidelines: “(1) Is the corporation’s compliance program well designed?; (2) [I]s the corporation’s compliance program adequately resourced and empowered to function effectively?; and (3) [D]oes the corporation’s compliance program work in practice?” Doing so requires a complete commitment on the part of the organization to (1) conduct a comprehensive risk assessment either in the form of an enterprise-wide risk assessment or a compliance risk assessment specifically; (2) implement internal controls and other mitigation efforts designed to detect and prevent suspicious payments or the provision of other inappropriate perquisites to government officials; and (3) a commitment to conducting comprehensive due diligence on all intermediaries, agents, service providers, and other third-parties (collectively, “representatives”).

Ongoing, risk-based due diligence of an organization’s third parties is perhaps the most powerful weapon in an organization’s ABAC arsenal. Under the revised DOJ Guidelines, it is critical that a company have a thorough understanding of all third-party qualifications, their association with politically exposed persons (“PEPs”), and the compensation/incentive structure utilized to remunerate such representatives. In addition, contract terms with third-parties should be adjusted to reflect the actual (not theoretical) potential for FCPA, UK Bribery Act or other legal violations. In other words, the days of utilizing boilerplate language for representatives that pose an elevated risk to the organization from a ABAC perspective are long gone. Instead, the compliance function of an organization should work closely with legal counsel to fashion appropriate contractual representations, warranties, and covenants commensurate with the risk posed by each intermediary. A breach of any such ABAC provisions should be considered material and immediate grounds for contractual termination—no exceptions. In addition, organizations may wish to consider the financial, reputational, and legal damage that might ensue from such a breach and require Representatives engaging in illegal activity to return any monies paid for legitimate services that were not rendered due to the intermediary’s malfeasance. Accordingly, careful thought should be accorded to incorporating rescission and recoupment language in agreements with third parties operating in countries that pose the greatest risk of corruption to the organization. Like so-called “clawback” provisions routinely employed under Dodd-Frank to recover bonuses paid to executives due to misconduct or poor performance, rescission and recoupment clauses—when carefully drafted—can have a similar effect with respect to a troublesome intermediary. Similarly, all contracts with an organization’s representatives should include robust audit and inspection rights, and a requirement that the third-party annually certify compliance with the organization’s ABAC policies and procedures.

Finally, it seems trite but necessary to emphasize that due diligence can become stale. To the extent an organization has no policy in place to periodically re-evaluate its relationships with third- parties, now is the time to consider implementing one. As both the DOJ Guidelines and proposed slate of recommendations recently issued by the Federal Deposit Insurance Corporation (“FDIC”), the Board of Governors of the Federal Reserve System (“Federal Reserve”), and the Office of the Comptroller of the Currency (“OCC”) emphasize, due diligence is not a single event in the life of an organization but part of a larger “lifecycle” that requires ongoing monitoring. Such monitoring is important to detect—among other things—financial changes negatively impacting the third party’s ability to perform as agreed under existing contract; legal and regulatory enforcement actions to which the intermediary may have been a party; changes in overall business strategy or expansion into other markets that might increase the third party’s legal risk; and concerning audit results that could be an initial indicator of a broader problem with a particular intermediary.

The long and short of the story concerning the Biden Memorandum is that anti-corruption prevention and enforcement efforts are now part and parcel of the overall national security strategy of the United States. Organizations accustomed to thinking of FCPA violations as simple regulatory infractions are ill-suited for this new era of potentially heightened scrutiny and substantial monetary and other sanctions for corporate offenders. As the Biden Administration’s recent actions demonstrate, the full resources of the federal government will be committed to achieving the President’s objective of curbing corruption—both foreign and domestic.

1 Response

[…] 10. Joe Biden-the anti-corruption President? Joe Acotoia in Corruption Crime and Compliance. […]