2021 False Claims Act Year in Review: Enforcement Statistics (Part I of II)

Worth the Wait? DOJ finally released its Fraud Statistics for FY 2021 and announced the “second largest amount recorded” since 1986: FCPA Settlement and judgment exceed $5.6 billion

Jessica Sanderson, Partner at The Volkov Law Group, joins us for her annual review of False Claims Act enforcement and issues. In Part I, Jessica reviews the enforcement statistics. In Part II, Jessica discusses False Claims Act developments in the courts and on Capitol Hill. Jessica can be reached at [email protected].

DOJ typically releases its False Claims Act (FCA) fraud statistics in early- to mid-January of each year, updating its statistics to reflect the settlements and judgments for the prior fiscal year. For the fiscal year October 1, 2020 through September 30, 2021 (FY21), those of us in the business of tracking these matters waited anxiously for the results, which were not released until last week, on February 1st. Once revealed, the numbers were astounding.

According to the accompanying DOJ Press Release, FY21’s recovery, “is the second largest annual total in False Claims Act history, and the largest since 2014.” Though the FCA actions that gave rise to these settlements and judgments likely were initiated before FY21, these significant recoveries show that AG Garland’s new Justice Department was quite active in pursuing and resolving FCA matters and insisting on accountability and substantial monetary penalties. And despite Covid-19, DOJ also was active in initiating new FCA matters. DOJ initiated 203 cases in FY21 (an average of 4 new matters per week), which similarly earns the second-place award – it is the second largest number of non-qui tam new matters opened in one year since DOJ began keeping track of these numbers. DOJ attributes the increase in government initiated FCA actions in large part to more sophisticated data analytics used to identify questionable patterns, trends, and outliers (see, e.g., remarks).

The DOJ’s Press Release provides context to the statistics and insight into upcoming FCA enforcement activity. Here’s what’s behind the numbers for FY21:

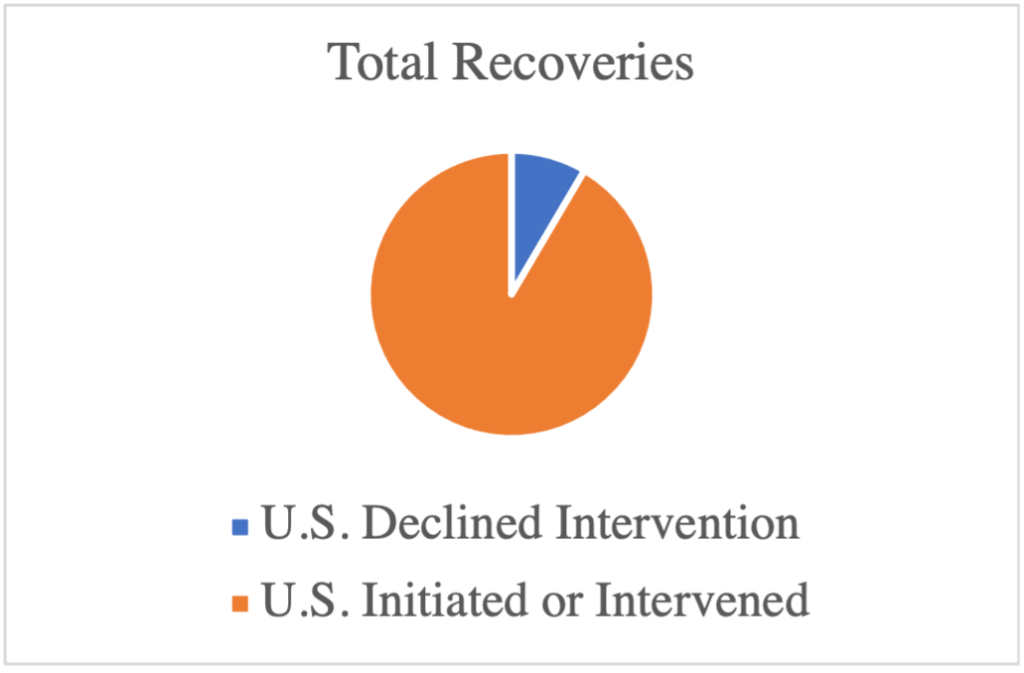

INTERVENTION IS OUTCOME DETERMINATIVE

Consistent with the past several years, the lion’s share of recoveries came from FCA matters where the government intervened or otherwise pursued the matter. Only 8% of the total amount recovered in FY21 came from qui tam actions where the government declined intervention. Year after year, the FCA statistics confirm that the most crucial stage of an FCA action for qui tam relators and defendants alike is during the government’s intervention decision-making process.

As to defendants, although they may not even be aware of a qui tam case filed under seal, in practice they often become aware that the government is considering pursuing an action (perhaps through receipt of a CID or subpoena). If possible, a defendant who learns of the existence of a qui tam action should be proactive and seek to meet with the government early on to present facts and arguments disproving the FCA allegations. Defendants also should take such an opportunity to emphasize the strength of their compliance program, discuss their internal investigation and response (if any), and otherwise demonstrate why it would not be an effective use of the government’s resources to intervene and pursue the matter (e.g., because there is little probability of success and/or the case is unlikely to result in a substantial recovery).

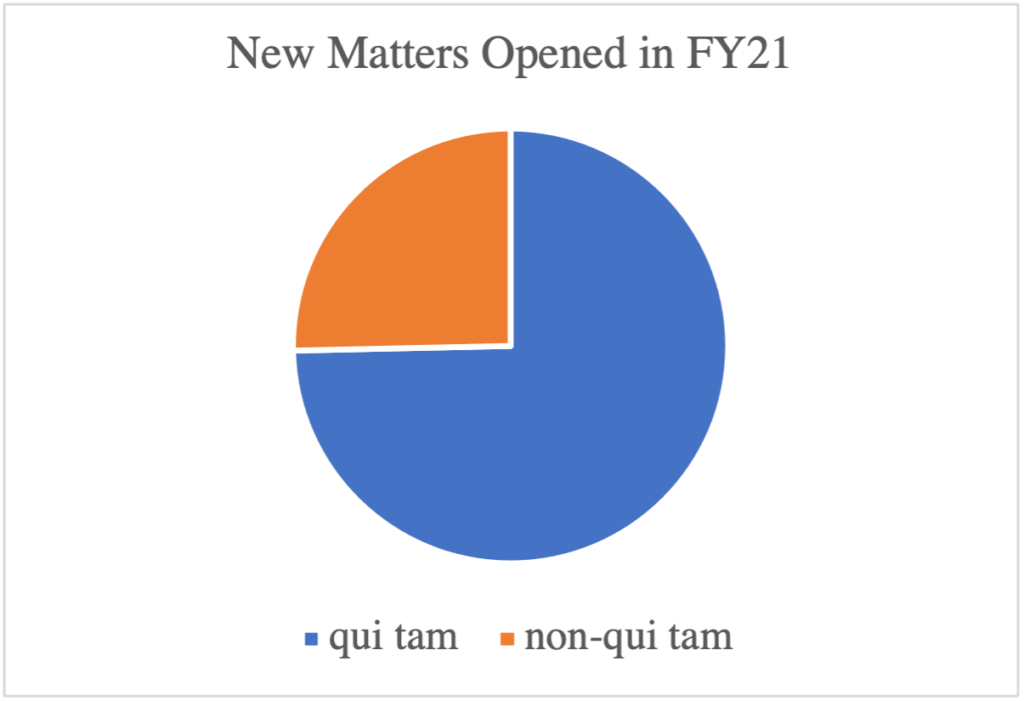

PRIVATE PARTIES CONTINUE TO DRIVE ENFORCEMENT

Also consistent with the past several years, qui tam relators or whistleblowers continue to drive enforcement. Private parties were responsible for initiating approximately ¾ of all new FCA matters in FY21. More than $1.6 billion of FY21 recoveries were attributable to qui tam lawsuits, and the government paid out $237 million to qui tam relators during this period.

DOJ’s Press Release encouraged private individuals to continue to expose fraud against the government, emphasizing that whistleblowers “are justly rewarded under the” FCA. As discussed further below, Acting Assistant Attorney General Brian M. Boynton similarly remarked at the outset of FY22 that DOJ “expect[s] whistleblowers to play a significant role in bringing to light knowing failures and misconduct in the cyber arena.”

Blog readers have heard us repeatedly emphasize the need for companies to have strong internal reporting policies and mechanisms, anti-retaliation protections, and investigation policies and procedures to, hopefully, learn about alleged misconduct and address whistleblower concerns before a would-be qui tam relator decides to file suit.

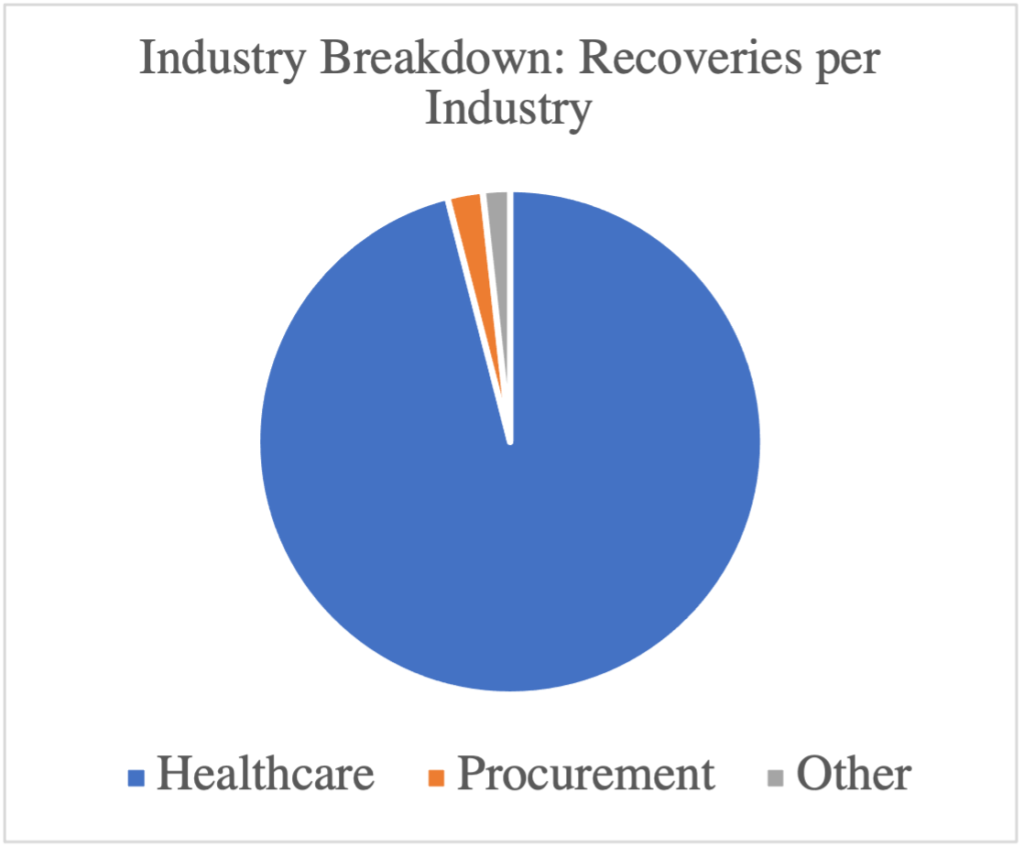

EFORCEMENTBY SECTOR: HEALTHCARE FRAUD CONTINUES TO DOMINATE RECOVERIES

HEALTHCARE FRAUD: Of the more than $5.6 billion in settlements and judgments, more than $5 billion, approximately 96%, of total recoveries in FY21 related to healthcare fraud in federal programs such as Medicare, Medicaid, and TRICARE. Again, this is consistent with prior years. However, this year, a significant portion of that more than $5 billion (more than 60%), is attributable to two significant resolutions with prescription opioid manufacturers: Indivior Inc. and Indivior plc and Purdue Pharma.

- The Indivior companies agreed to pay more than $209 million to the federal government to resolve FCA allegations regarding the promotion of the opioid-addiction-treatment drug Suboxone.

- Purdue agreed to pay the federal government $2.8 billion related to its fraudulent promotion of opioid drugs. Separately, certain individuals (shareholders and board members of Purdue) agreed to pay $225 million to resolve FCA allegations related to the marketing of OxyContin.

Within the healthcare industry, DOJ announced certain investigation and litigation priorities, in addition to combatting fraud in the opioid market, including matters related to the Medicare Advantage program (also known as Medicare Part C), unlawful kickbacks, which are “pernicious because of their potential to subvert medical decision-making and to increase healthcare costs,” and unnecessary medical services.

PROCUREMENT FRAUD: Of the more than $5.6 billion in total settlements and judgments, only $120 million (2%) of total recoveries related to procurement fraud, predominantly within the Department of Defense. In this area, the DOJ pursued a variety of fraud matters involving the government’s purchase of goods and services, for example where government contractors falsified pricing data, provided non-compliant goods or services, or engaged in unlawful kickback schemes. Though this percentage of recoveries is fairly consistent with prior years (recoveries in this area approximated 3% in FY20), we are surprised that the number of cases and recoveries involving government contracts is so low.

“OTHER”: The remaining 2% of recoveries for FY21 are grouped into a catch-all category that DOJ tracks as, “other” recoveries primarily consisting of fraud in other government programs. For example, in FY21 DOJ resolved matters involving fraud in the federal Supplemental Nutrition Assistance Program (SNAP) program, the Federal Housing Administration loan program, fraud against the U.S. Customs & Border Protection agency (underreporting the value of imports), and non-competitive bidding practices in connection with the Federal Communications Commission’s (FCC) E-Rate Program. DOJ also pursued fraud in connection with payment of gas royalties (on federal lands). DOJ also reported some relatively small recoveries in connection with the pandemic-related Paycheck Protection Program, enacted to provide loans guaranteed by the U.S. Small Business Administration to eligible small businesses to cover payroll, rent, and other business-related costs.

WHAT TO EXPECT FROM DOJ IN FY22:

Early in the calendar year, in his February 17, 2021 speech at the Federal Bar Association Qui Tam Conference, Acting Assistant Attorney General Brian M. Boynton communicated the DOJ’s FCA enforcement priorities for the year starting with “pandemic-related fraud.” As noted above, there were few actual recoveries in this area during FY21, but we expect they are in the works. DOJ’s February 1, 2022 Press Release noted a continued focus in this area given the “historic levels of emergency funding for federal agencies,” provided during the Covid pandemic, leading us to expect more activity and recovery related to fraudulent claims for, or misuse of, pandemic relief fundsin the coming year. Indeed, DOJ also noted that it has been working closely with “various Inspector Generals and other agency stakeholders to identify, monitor and investigate the misuse of critical pandemic relief monies.”

On May 18, 2021, Senator Grassley sent a letter to HHS OIG trying to light a fire under this agency’s inspector general, stating, “It is critically important that the Department of Health and Human Services, Office of Inspector General continue to identify and investigate allegations concerning the misuse or misappropriation of pandemic relief funds.”

DOJ’s February 2022 Press Release also emphasized enforcement in the area of cyber fraud, referencing President Biden’s May 12, 2021 Executive Order focused on preventing, detecting, assessing, and remediating cybersecurity incidents affecting federal government networks. Along those same lines, at the outset of FY22, on October 6, 2021, Deputy Attorney General Lisa O. Monaco announced the DOJ’s “Civil Cyber-Fraud Initiative,” which will use the FCA to combat new and emerging cyber threats. DOJ promises to hold government contractors and grantees liable to reimburse “the government and the taxpayers for the losses incurred when companies fail to satisfy their cybersecurity obligations.”

The following week, Acting Assistant Attorney General Brian M. Boynton delivered remarks at the Cybersecurity and Infrastructure Security Agency (CISA) Fourth Annual National Cybersecurity Summit, in which he reaffirmed, “The Civil Cyber-Fraud Initiative will use the False Claims Act to identify, pursue and deter cyber vulnerabilities and incidents that arise with government contracts and grants and that put sensitive information and critical government systems at risk.” DOJ already has secured additional department resources for the initiative, appointed a supervisor in the Fraud Section as Chairperson of the Cyber-Fraud Initiative, created a distinct mechanism for reporting cyber fraud, and is partnering with numerous agency OIGs.

Boynton identified “at least three common cybersecurity failures that are prime candidates for potential” FCA enforcement through the Cyber-Fraud initiative: (i) the knowing failure to comply with cybersecurity standards; (ii) the knowing misrepresentation of security controls and practices; and (iii) the knowing failure to timely report suspected breaches. As such, we expect to see a number of qui tam and enforcement actions in these areas this coming year.

DOJ’s February 2022 Press Release also stressed its commitment to hold individuals accountable for FCA violations. In FY21, as noted above, DOJ held senior Purdue representatives including members of the Sackler family individually accountable. DOJ also resolved actions with a handful of doctors who billed federal healthcare programs for medically unnecessary procedures and tests. In addition, the former owner of a substance abuse treatment center agreed to pay an $3 million of his personal funds and to divest himself of ownership and control of the entity. This sends a strong message to Board members, major shareholders, and senior executives of government contractors, healthcare companies, and any entity that receives government funds that they should take their compliance program oversight responsibilities seriously and challenge management to implement effective compliance and ethics programs to mitigate the risk of FCA liability.