Former MoviePass Executives Indicted for Securities Fraud

The old adage — if it sounds too good to be true, then it probably isn’t — still rings true when it comes to MoviePass, which ultimately resulted in a criminal indictment charging two former executives with securities fraud.

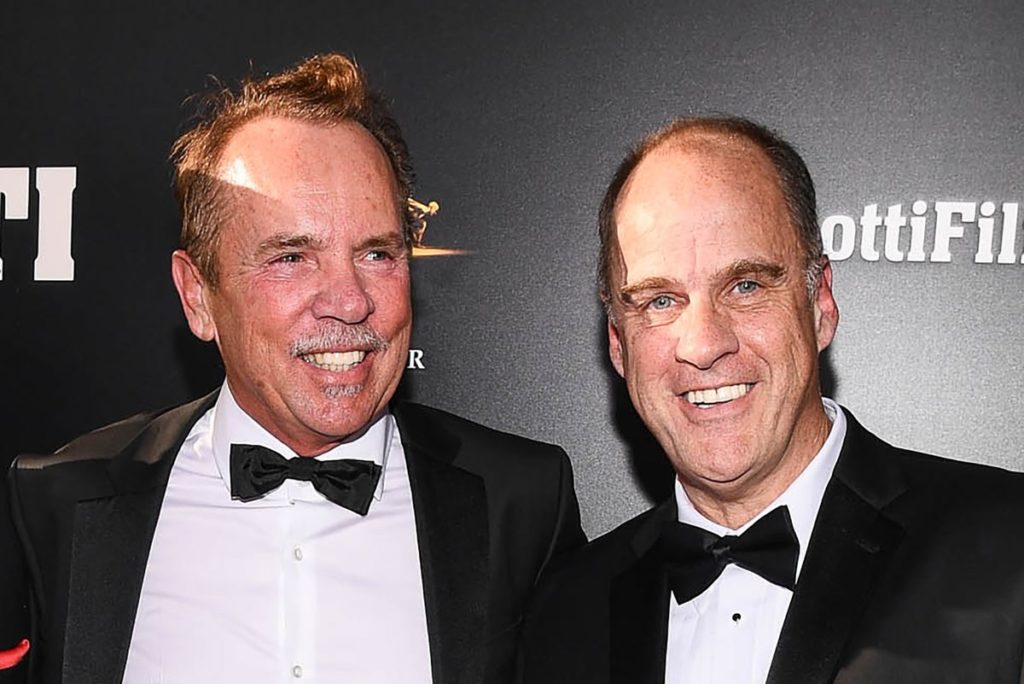

Theodore Farnsworth and Mitchell Lowe were charged with a scheme to defraud investors through materially false and misleading representations relating to MoviePass’ parent company, Helios & Matheson Analytics Inc. (“HMNY”), a publicly-traded company, in order to inflate the price of HMNY’s stock. Farnsworth was HMNY’s Chairman and CEO and Lowe was MoviePass’ CEO.

The SEC filed a parallel civil action and named another defendant, Khalid Itum, MoviePass’ former executive vice president.

Farnsworth and Lowe made materially false and misleading representations in press releases, SEC filings, media interviews on podcasts and television, and in print and online media, all of which were intended to promote MoviePass to investors and the general public.

To remind everyone, MoviePass cost $9.95 monthly and would allow subscribes to view “unlimited” movies in theaters with no blackout dates. MoviePass claimed that its plan was tested, sustainable and profitable on the subscription price alone. However, Farnsworth and Lowe knew that the $9.95 “unlimited” plan was a temporary marketing gimmick to add subscribers and artificially inflate HMNY’s stock price. In fact, HMNY lost money from the $9.95 unlimited plan.

Additionally, Farnsworth and Lowe made false claims that HMNY used cutting edge, data technologies to analyze and monetize MoviePass information from subscriber data. Again, Farnsworth and Lowe did not have these technologies nor did they have any intention of implementing these technologies.

Farnsworth and Lowe also falsely claimed that MoviePass maintained multiple revenue streams (aside from subscription fees) that increased MoviePass’s profitability. These statements were misleading because Farnsworth and Lowe knew that MoviePass did not have non-subscription revenue streams that would make up for MoviePass’s losses from its unlimited monthly plan.

Farnsworth and Lowe also falsely claimed that MoviePass’s cost of goods was declining over time as the number of subscribers increased, However, Farnsworth and Lowe directed employees to prevent certain subscribers from using the unlimited service to ease MoviePass’s cash shortfalls.

In a January 2018 interview with Yahoo Finance, Farnsworth said MoviePass would be financially self-sufficient in 60 days, claiming that it would have multiple revenue streams from deals with studios and exhibitors, none of which was true.

Farnsworth and Lowe were each charged with one count of securities fraud and three counts of wire fraud. If convicted, the maximum penalty of 20 years in prison on each count.

1 Response

[…] Source link […]