The SEC Sues Cryptocurrency Exchange Binance Alleging Sweeping Securities Violations

Matt Stankiewicz, Partner at The Volkov Law Group, joins us for a post detailing the SEC’s recent suit against Binance. Matt can be contacted at [email protected].

In a complaint filed June 5, 2023, the U.S. Securities and Exchange Commission (“SEC”) is suing the world’s largest cryptocurrency exchange – Binance Holdings Ltd. (“Binance”), BAM Trading Services Inc. (“BAM Trading”), BAM Management US Holdings Inc. (“BAM Management”), Binance’s U.S. affiliate Binance.US, and the company’s owner and CEO Changpeng Zhao (often referred to as “CZ” by the industry). The SEC’s complaint claims that Binance and its related entities operated as an unregistered exchange, broker, and clearing agency, made unregistered offerings and sales of crypto assets; failed to restrict U.S. investors from accessing Binance.com (as opposed to its U.S. counterpart); and misled investors.

Overall, the SEC contends that the company was aware that it was operating an unregulated securities platform. The SEC cites to messages from an internal company chat where Binance’s Chief Compliance Officer admitted to another compliance office that ““we are operating as a fking unlicensed securities exchange in the USA bro.” This is a great reminder for everyone to always be careful what you put into an email or chat as it could be a headline in litigation at some point.

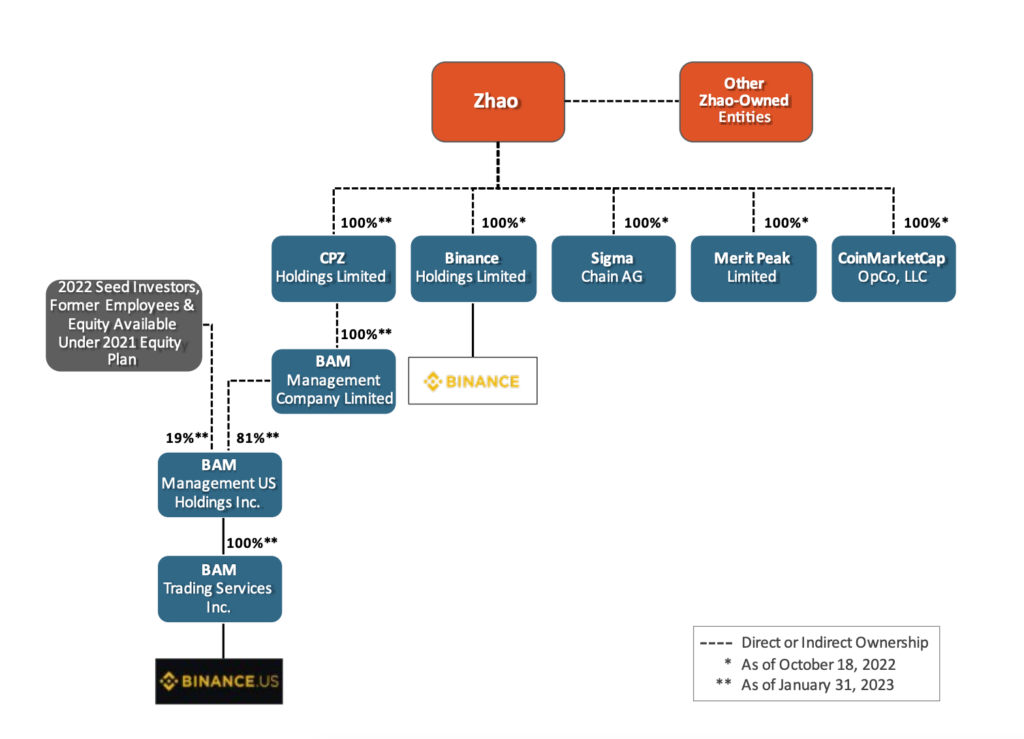

For some background, Binance is the world’s largest cryptocurrency exchange. Originally founded in China, the company is now based out of the Cayman Islands. The company allows its users to buy, sell, and trade various cryptocurrencies. It offers one of the most comprehensive listings of crypto assets compared to any other platform. In 2021, the company boasted $9.58 trillion in cryptocurrency trading volume, and earned Binance earned $11.6 billion in revenue from transaction fees between June 2018 and July 2021. It’s CEO, CZ, has an estimated net worth of $10.5 billion stemming from his ownership of the exchange. He is active on social media and a well-recognized personality within the industry. The structure of his various entities, as detailed in the complaint, is below:

Publicly, Binance has maintained that Binance.US is a separate entity that effectively operates under a licensing agreement with the parent company. CZ and Binance set up BAM Management and BAM Trading in the U.S. and claimed they independently controlled the U.S. operations. According to the company, Binance.US operated independently though utilized Binance’s name and its proprietary technology. The government contends that this public stance does not accurately reflect the control that Binance exercises over its U.S. entity. The SEC cites to statements made by employees of the U.S. entities to support the claim that CZ and Binance ultimately maintained significant control over all of the U.S. operations.

Several of these statements were made by executives, including when BAM Trading’s first CEO, Catherine Coley, told Binance’s CFO that her “entire team feels like [it had] been duped into being a puppet.” Brian Brooks, former U.S. Comptroller of the Currency, served as CEO of Binance.US before resigning only three months into his tenure. Brooks previously testified that what “became clear to me at a certain point was CZ was the CEO of BAM Trading, not me.” He also testified that while he tried to rework Binance.US into a more compliant exchange, but was “overruled” on everything that he did. At some point Brooks realized “I’m not actually the one running this company” and decided to leave.

Furthermore, the parent company maintained control over almost all of Binance.US’s data. Binance.US employees could not access real-time trading data as it was maintained offshore with the parent entity. The complaint also refers to the “Tai Chi” plan that was leaked to Forbes last year, which detailed a strategy for Binance to create a U.S.-based exchange and continue to control it while obfuscating that reality. It appears that Binance may have implemented the majority of the recommendations from this plan.

Furthermore, the SEC contends that Binance’s main platform, based outside of the U.S., frequently served U.S. customers. While the exchange claims to have implemented controls to block U.S. customers back in 2019, these controls were often circumvented, sometimes with knowledge and aid by Binance employees. The SEC alleges that CZ himself directed Binance employees to help their most valuable U.S. customers circumvent the controls in order to continue trading on the offshore platform. The complaint quotes CZ as stating that his “goal” was “to reduce the losses to ourselves, and at the same time make the U.S. regulatory authorities not trouble us.” Until 2021, Binance allowed any of its users to withdraw up to two Bitcoin per day (or just over $90,000 as of August 2021’s closing price) without going through any KYC process. Ultimately, this is often the dirty secret of the crypto-trading industry and is not exclusive to Binance. Many foreign exchanges actively employ lax controls in this regard, and typically work to solicit customers from the very lucrative U.S. market. Previously, BitMEX found itself in major trouble for these same type of actions. Before its implosion, FTX was alleged to be conducting itself in the same manner.

Additionally, Binance lacked basic controls that are required of registered exchanges. The SEC alleges that “wash trading” and self-dealing was rampant throughout the exchange. Even worse, the CZ-owned company Sigma Chain AG (“Sigma Chain”) was alleged to be conducting wash trades in order to artificially inflate the exchanges trading volume. CZ also controlled another company, Merit Peak, which actively traded on the Binance platform, as did Sigma Chain. As these companies frequently traded against Binance’s users, the use of these companies presents significant conflicts of interest. The set-up is reminiscent of FTX’s use of Alameda Research, which is at the heart of that company’s legal troubles.

Arguably the most damning allegation from the SEC’s complaint is that Binance comingled customer funds with its own. At a high level, the various bank accounts of all of the Binance entities were ultimately controlled by CZ. He would frequently direct employees to move funds between the accounts with little documentation as to the reasons behind the transfers. Furthermore, even the crypto assets were comingled, as most user funds were moved to wallets centralized with Binance, with CZ holding ultimate control. According to the SEC, these actions create substantial risk for U.S. investors and were never disclosed. Binance was also aware of these issues, along with other significant control deficiencies, as an external auditor highlighted them in a report submitted to CZ and the Board. The complaint also suggests that Binance sent funds to Sigma Chain and Merit Peak, and that Sigma Chain even used these funds to purchase an $11 million yacht.

The SEC also contends that Binance offers several securities on its platform. First, the SEC calls out two Binance-specific tokens, the exchange’s BNB token and its stablecoind BUSD. Furthermore, the SEC considers ten other tokens unaffiliated with the exchange as secuties. These tokens are Solana, Cardano, Polygon, Filecoin, Cosmos, The Sandbox, Decentraland, Algorand, Axie Infinity, and COTINetwork, trading under the symbols SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI, respectively.

The SEC has yet to file suit against these tokens, despite alleging them to be securities. The Solana Foundation has already released a statement vehemently disagreeing with the SEC’s characterization of its token as a security. Solana, meanwhile, has many close ties with the U.S. This case then presents a unique legal challenge. For the SEC to prove its allegation that Binance sold securities on its platform, the court must accept the fact that these tokens are in fact securities. That’s ultimately the heart of the matter. Which also means that these tokens themselves are not even a party to the case that may determine their asset classification. It’s as if the SEC is trying to sneak legal precedent against these tokens through a backdoor. This may be due to the company’s challenges in its action against Ripple.

A day after filing the complaint, the SEC filed a motion to freeze the assets of BAM Trading, BAM Management, and Binance.US in order to “ensure the safety of customer assets and prevent the dissipation of available assets for any judgment.”

2 Responses

[…] suing Coinbase for failing to register its staking-as-a-service program. This suit follows a similar one filed against Binance only a day prior. The SEC has clearly set its sights on the crypto industry by targeting the […]

[…] be suing Coinbase for failing to register its staking-as-a-service program. This swimsuit follows a comparable one filed in opposition to Binance solely a day prior. The SEC has clearly set its sights on the crypto trade by focusing on the 2 […]