SEC and DOJ Charge SafeMoon Cryptocurrency and its Executives For Multi-Million Dollar Fraud

Matt Stankiewicz, Partner at The Volkov Law Group, provides a post on the latest fraud charges in the cryptocurrency industry, brought against SafeMoon. Matt can be reached at [email protected].

On November 1, 2023, the U.S. Department of Justice (“DOJ”) and U.S. Securities and Exchange Commission (“SEC”) brought charges against cryptocurrency project SafeMoon LLC and its U.S. subsidiary SafeMoon US LLC, along with its three executives, Kyle Nagy, owner and founder; John Karony, Chief Executive Officer; and Thomas Smith, Chief Technology Officer (collectively “Defendants”). The SEC charged the defendants for perpetrating a massive fraud scheme through the unregistered offer and sale of a security with its SafeMoon Token. Meanwhile, the DOJ brought criminal charges for conspiracy to commit securities fraud, conspiracy to commit wire fraud and money laundering conspiracy.

SafeMoon was a cryptocurrency project launched in March 2021 during one of the cryptocurrency industry’s large “bull runs.” The token had little utility to it, but quickly became something of a viral sensation as a “meme coin.” The token surged in price by over 55,000% in its first two months. The total market cap of SafeMoon rose to over $5.7 billion and more than 2 million unique wallet addresses owned SafeMoon during this short time period. Thanks to an aggressive marketing campaign, even non-crypto personalities took notice. For example, Dave Portnoy, owner and founder of Barstool Sports, famously purchased SafeMoon tokens during one of his investment podcasts, which caused another surge in pricing as his followers bought into it as well. Portnoy was subsequently sued by SafeMoon investors after the coin lost more than 90% of its value.

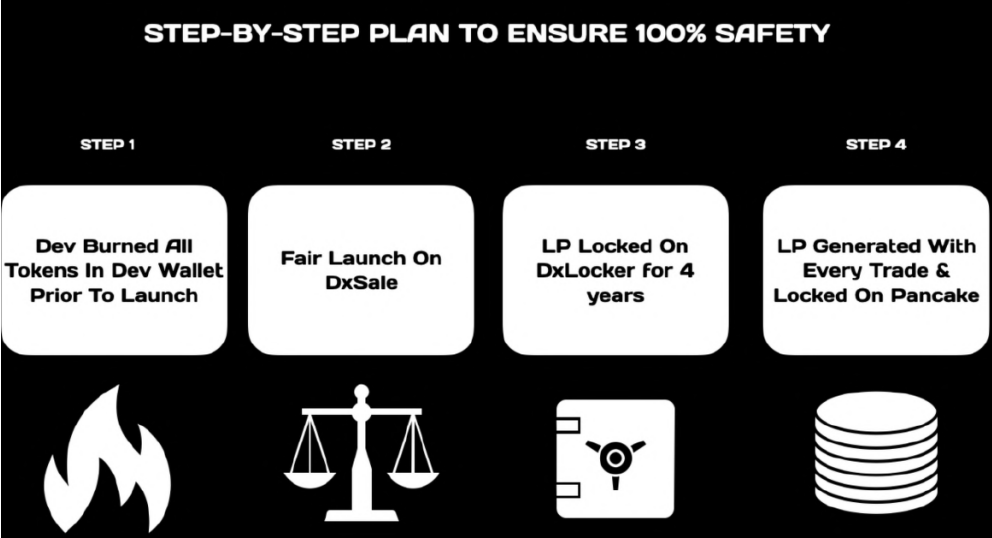

SafeMoons whitepaper, website, and other marketing materials explained that the token was subject to a 10% tax on every transaction that would benefit all SafeMoon holders. Through this tax, 5% would be returned to all current SafeMoon holders in proportion to their current holdings and the remaining 5% would be deposited into a SafeMoon liquidity pool, which increased the liquidity in the market for users to trade SafeMoon. These marketing materials further represented that the tokens sent to the liquidity pool would be subject to a four-year locking period. The purpose of this locking period, as represented, was to prevent any misappropriation of the funds, or to avoid a “rug pull”—a colloquial term in the crypto industry where founders of a project instead steal all of the liquidity from its users. In all of its marketing materials, SafeMoon was constantly dubbed as a safe investment.

Contrary to these representations, all of the Defendants had access to the funds in the liquidity pool. In actuality, the tax provided the Defendants with LP tokens, which are essentially a claim against the funds within the liquidity pools. Which means Defendants were able to exchange those LP tokens directly for funds within the pool, and they frequently did so in order to enrich themselves. At no point did the SafeMoon team ever disclose this access. Public blockchain experts, meanwhile, reviewed the SafeMoon smart contract and realized that Defendants had access to the taxes in the liquidity pools. Following this revelation, rather than admit what was going on, Karony and Smith instead represented that they would never remove funds from the SafeMoon pools without first disclosing to the public their intent to do so and the intended use of those funds. As you may have guessed, they did not keep that promise. The Defendants were able to hide their misappropriation by masking the movement of these funds across various private, unhosted wallets and pseudonymized centralized exchange accounts.

As the SEC complaint charges, Defendants “raided” these pools to fund a lavish lifestyle. During the course of their fraud, Defendants redeemed LP tokens for tens of millions of dollars. They used this money for various purposes, including paying for business expenses as well as personal purchases. The Defendants purchased luxury homes in several states, including Utah, New Hampshire, and Florida. They bought sports cars including multiple McLarens and a custom Porsche 911. The group also made extravagant travel purchases, such as multiple flights on private jets. The Defendants even used the funds to manipulate the SafeMoon token price in order to further enrich themselves. Between April9, 2021 and December 31, 2021, Karony used roughly 50 trillion SafeMoon tokens to conduct wash trades between two accounts he controlled. On 188 trading days during this period, Karony accounted for 95% of all SafeMoon trading volume through these wash trades.

Karony and Smith have since been arrested. Nagy currently remains at large according to the DOJ. The price of the SafeMoon token is down over 90% from its all time high and is currently worth $0.00005938 per token.