Stepping Into the Enforcement Spotlight — Customs and Border Patrol and Import Enforcement (Part I of II)

The Trump Administration is committed to a re-defined objective of fair trade. This will have a significant impact on all businesses, across all operational functions. This is not surprising — for years, the United States has pushed global trade as an objective unto itself. The Trump Administration is raising important questions concerning the benefits to U.S. consumers and workers.

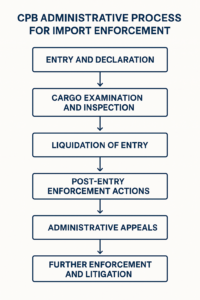

As part of this new international trade framework, the Trump Administration has identified the Customs and Border Patrol as a critical player in the enforcement of U.S. trade laws. CPB has a broad mandate to ensure compliance with trade laws, detect and prevent violations and protect national security. In this respect, CPB can impose regulatory penalties for violation, seize goods and take legal actions against individuals and companies. In serious cases, CPB will refer investigations for civil or criminal prosecution. On top of these trade enforcement obligations, CPB plays a critical role in prosecuting forced labor and intellectual property rights.

CPB maintains an e-allegations Program under which individuals and companies can report allegations of trade violations. Under the Enforce and Protect Act (EAPA), CPB’s authority was expanded to include investigation and enforcement against importers who evade antidumping or countervailing duties.

CPB relies on a variety of investigative sources to initiate investigations, including increased bonding, enhanced targeting, and inspection of high-risk imports.

The CPB invites parties with information about an ongoing investigation to contact a party to the investigation to add information to the administrative record. Alternatively, a person may file a separate EAPA allegation if the regulatory requirements for standing are satisfied, or a party may file an e-Allegation to provide information directly to CPB New EAPA and e-allegations have to be filed through CPB’s online portal.

The CPB website includes a list of EAPA investigations and determinations. These enforcement actions include a number of products such as food products, metal lockers, woven ribbons, thermal paper, glycine and many other products subject to antidumping and countervailing duties. The CPB enforcement actions include notice of initiation of an investigation and interim measures, which usually follows with notices of determinations re evasion. In the end, CPB identifies and outlines steps taken by violators to circumvent these duties by transshipment involving other countries.

Section 1592 of the Tariff Act of 1930 (19 U.S.C. §1592)

The CPB’s enforcement authority springs from Section 1952 of the Tariff Act, 19 U.S.C §1592). CPB relies on this provision to ensure compliance with the Harmonized Tariff Schedule of the United States (“HTSUS”) for classification, valuation and other import regulations. Specifically, Section 1592 governs civil penalties for false statements, omissions and other misconduct in relation to the importation of goods into the United States.

Section 1592 prohibits any person, by fraud, gross negligence or negligence from entering, introducing or attempting to enter or introduce merchandise in U.S. commerce by means of any material and false document, statement, act, electronic data or omissions. The provision applies to importers and any other person who aids or abets or causes a violation.

The seriousness of a violation depends on the specific standard alleged — fraud, gross negligence or negligence. Fraud is defined to cover a voluntary and intentional act or omissions done to deceive the government. Gross negligence is a severe degree of negligence involving reckless disregard and negligence is defined to include a failure to exercise reasonable care.

A false statement or omission must be material — which means that it affected CPB’s decision to allow entry, appraise merchandise, assess or duties. Like other government enforcement programs, individuals and companies can earn significant benefits from a voluntary disclosure. 19 C.F.R. § 162.74. CPB does not have to show the U.S. suffered a loss in order to impose penalties. Administrative penalties can be mitigated during administrative proceedings based on various factors including voluntary disclosures or corrective actions.

A simple example of an administrative enforcement action is: An importer declares the value of its imports as 100,000, when the correct value is $500,000. The lawful duty ius 10 percent or $50,000. If CPB finds fraud, the penalty could reach the full domestic value of up to $500,000; if gross negligence, the penalty would be up to 4 x $50,000 = $200,000; or, if negligence then the penalty would be up to 2 x $50,000 = $100,000.