Cartel and TCO Due Diligence and Risk Factors (Part II of II)

Cartels and TCOs have entrenched themselves in legitimate industry sectors. In recent years, cartels and TCOs have adapted to market changes and new technologies. Many cartels and TCOs are disguising their ownership and financial interests through shell companies, sophisticated networks of third parties and legitimate businesses in real estate, construction, mining, agriculture, export/import, casinos, fintech platforms and finance.

The Sinola Cartel in Mexico operates in several “legitimate” sectors including agriculture, mining, real estate and logistics. The First Capital Command (“PCC”) in Brazil plays a significant role in drug trafficking but has legitimate businesses in the transportation, retail, construction and agricultural markets. In Italy, organized crime in Calabria and Naples have invested in hotels, real estate, energy companies and other legitimate businesses. In West Africa, criminal networks have infiltrated legitimate financial networks and services, especially involving cryptocurrency and remittance fraud.

Due Diligence Checklist

To address these potential risks, companies have to identify significant regional and country-specific risks. Depending on the sector, the level and scope of due diligence should vary based on risk factors including geographic location, nature and size of business relationship, and presence of complex corporate structures. To translate this into well-known principles, a cartel and TCO analysis requires careful identification of red flags.

Beneficial Ownership: In the cartel and TCO context, companies have to verify beneficial ownership, trace corporate ownership structures and require documentation to confirm the natural person(s) who ultimately control or own a business. Besides complex, multi-level corporate structures, companies should readily identify risks associated with nominees and trusts.

Financial Transaction Monitoring: Contracts and purchase orders with high-risk entities or individuals have to include access to financial records . Suspicious activities should be flagged and third-party payments have to be flagged for follow up and investigation.

Open-Source Investigations: Screening platforms and workflow management are critical to organize and mitigate cartel and TCOs risks.

Trade Data: TCO activity in trade-based money laundering activities is a significant risk. Customs and trade data may provide important insights, including customs fraud and product flows into and out of jurisdictions with low transparency and high-risk trade activities.

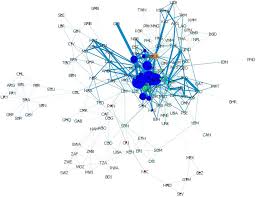

Sanctions and Watchlists: The screening of entities and individual against sanctions and watchlists can be used as a starting point for a link analysis — meaning related entities and individuals that may be linked to a potential supplier or third-party distributor.

Indirect Ownership Interests: Cartels and TCOs are developing cross-jurisdiction operations to disguise ownership and controlling interests. For example, a specifici investment in a company in country A, may be owned by a Panamanian holding company, a trust in Belize or a Guernsey, offshore entity. Aside from bizarre ownership structures, the flow of funds when received by a company that has an unexplained path through Dubai, Cyprus and other questionable financial hubs should be examined and weighed.

Traditional Risk Factors: When reviewing a potential or existing relationship, it is important to examine the traditional factors such as cash-intense businesses, unexplained wealth, complex ownership structures with no commercial rationale and links to other sanctioned jurisdictions.