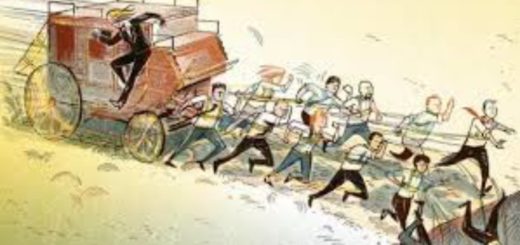

When Business Supersedes Compliance – A Recipe for Disaster

When looking through the wreckage of a major corporate compliance disaster, it is relatively easy to spot the important events when business needs (or money) are consciously elevated over compliance concerns or even reputational risks. It is easy to spot the circumstance, and with perfect hindsight announce to everyone (assuming someone is listening) that you would not have followed that course of action. In the...