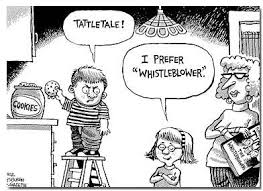

Whistleblowers – Tracking Ups and Downs

One of many things about life – just when you think you know something, it turns out you do not. Or another trite way to say the same thing – Life is full of surprises.

One of many things about life – just when you think you know something, it turns out you do not. Or another trite way to say the same thing – Life is full of surprises.

The evolution in the treatment and legal protection of whistleblowers over the last five years has been remarkable. Just when you think there is one trend, out comes another.

What do I mean by this?

For years, the FCPA Paparazzi has been warning everyone about the coming Armageddon – SEC whistleblowers will be filing complaints left and right, collecting rewards and companies will be lined up on the chopping block with FCPA settlements in hand.

Looking back today, the FCPA Paparazzi, yes, believe it or not, got it wrong. Less than 10 percent of whistleblower complaints have focused on bribery issues. In fact, the largest percentage has been about accounting fraud or other financial reporting issues (e.g. revenue recognition).

Another interesting trend, as reported by the Wall Street Journal, was the slow payments to SEC whistleblowers. So, the potential gold mine has turned out in many respects to be less than bountiful.

The SEC, however, is committed to the cause; it just is slow on paying rewards. Instead, the SEC has been seeking to free potential whistleblowers from confidentiality restrictions imposed by companies in separation agreements with officers and employees. That could be a very interesting trend that leads companies to avoid including this standard protection in such agreements.

A recent survey (Here) reported some interesting perceptions of whistleblowers. Nearly 40 percent of those responding were not even aware of the SEC whistleblower program – that is shocking to say the least, given the attention to the issue in the business community.

Also, nearly 30 percent of those responding cited their company’s confidentially agreements as prohibiting them from reporting misconduct to law enforcement. One quarter of the respondents cited the fact they had signed a confidentiality agreement that included a provision prohibiting the reporting of illegal or unethical conduct to law enforcement.

Most importantly from the survey, almost twenty percent of those responding stated that their company would retaliate against them for reporting wrongdoing.

There good and bad associated with whistleblowers. One can never generalize about anyone ion corporate governance landscape.

On the plus side, I am confident that the SEC’s whistleblower program, combined with increased attention to ethics and compliance programs, has reduced the incidence of employee misconduct and increased the likelihood that someone would report a colleague for engaging in misconduct.

On the plus side, I am confident that the SEC’s whistleblower program, combined with increased attention to ethics and compliance programs, has reduced the incidence of employee misconduct and increased the likelihood that someone would report a colleague for engaging in misconduct.

On the negative side, and this is a big negative, until companies actually fire or seriously discipline some for retaliation, employees will always be reluctant to report misconduct for fear of retaliation. Companies can say what they want but until they actually act on it, employees are going to question whether or not retaliation will be identified or even punished. That is a real challenge for compliance officers, but if given the opportunity to discipline someone for retaliation, they need to take advantage of the opportunity to demonstrate in real and tangible terms the company’s commitment to a speak up culture.

1 Response

[…] Fox dives deeper into FIFA. The FCPAProfessor sprinkles potpourri. Mike Volkov tracks whistleblower trends. The FCPA Blog analyzes the language of bribery. Richard Bistrong wonders if […]