Barclays Agrees to Pay the SEC $6.3 Million to Settle FCPA Offenses for Hiring of Relatives of Foreign Officials in Asia

Barclays joined the club of global financial institutions settling FCPA violations for hiring of relatives of foreign officials in Asia. Barclays agreed to disgorge $3.8 million and paid prejudgment interest of nearly $1 million and a $1.5 million civil penalty.

As outlined in the SEC settlement order (here), Barclays Asia Pacific Region hired 117 job candidates referred by or connected to foreign government officials or non-government clients. Some of individuals hired individuals who were relatives and friends of government officials and executives of Barclays’ non-government clients with the expectation that the bank would gain investment banking business.

Barclays APAC employees also created false records to conceal the true identity of the person or the entity requesting that a candidate be hired and the reasons for the hire. In April 2009, a senior APAC executive approved an “unofficial intern” program for Barclays in South Korea that was operated separately from Barclays’ formal internship program. Approximately half of the candidates in the unofficial program for Barclays South Korea were connected to Barclays’ clients.

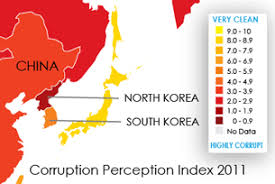

According to a senior banker responsible for the program, “the key factor behind relationship hiring decisions was what business the client could deliver to the bank.” The senior banker explained that the relationship hiring decisions were made based on whether the client was important, whether the hiring would enhance the business relationship, and whether hiring the candidate would result in new business. The improper hiring practices began in South Korea and then expanded to other Asian countries.

Surprisingly, Barclays compliance officers were aware of the hiring practices by June 2009, but claimed that they were not aware that its anti-corruption policy prohibited such hiring program. Indeed, in an astounding claim, a senior APAC compliance executive claimed that he had never read Barclays 2009 anti-bribery and corruption policy and that he himself did not understand that compliance was required to review and approve internships or other hiring decisions involving relatives of foreign officials.

A Barclays senior executive claimed that he never knew that offers of employment were items of value under anti-corruption laws. This same lack of knowledge was echoed by several other Barclays bankers.

In September 2010, APAC bankers requested approval to hire the daughter of a foreign official who was the senior executive of a Chinese state-owned enterprise. The daughter performed poorly during the interview process and received a “do not hire” recommendation. Nonetheless, the relationship banker pushed to hire her anyway. When a senior compliance officer was asked to review the hiring, he candidly stated that such a questionable hiring would not be the first time of such an improper hiring. He eventually approved the hiring conditioned on assurances that she had the qualifications to be hired. No assurance was ever provided.

Barclays conducted compliance reviews in APAC during 2011 and 2012 but continued to hire candidates connected to officials at state-owned entities or executives of private clients with whom business was either ongoing or being sought. A Barclays banker who worked in both South Korea and Hong Kong from June 2005 to March 2017 admitted that he was not aware of the FCPA until 2013.

During 2011 to 2013, Barclays APAC continued to hire based on relationships with foreign officials and non-government clients.

In May 2011, APAC adopted the work experience program, which set forth procedures governing relationship hires and adopted specific controls to identify candidates that were referred for hiring by a client and to explain the rationale for hiring the candidate. Unfortunately, the program requirements were circumvented or ignored in a number of candidate hires. In one instance, a senior banker in Kores falsified a candidate’s connection to a senior executive from a client and a specific contract for issuance of private bonds for a private Korean bank.

In March 2012, Barclays revised its internal policies regarding referral hires to require an attestation that the hire was not being made for the purpose of obtaining or retaining business. The new requirement had little to no impact on the approval of relationship hires in APAC. Bankers sometimes provided inaccurate attestations and even when the disclosure was accurate, compliance approved the hires despite pending or potential business.

In June 2012, a business presentation identified “strategic hiring” as one component of an action plan to satisfy clients. Even though the presentation was distributed among high level executives, no one objected to the presentation.

Even with a compliance approval requirement, Barclays bankers in APAC continued to make hires with an intent to advance specific business relationships.

In January 2013, Barclays’ global compliance increased its scrutiny of relationship hiring. Compliance issued a global alert reminding all employees of the prohibitions and review requirements for employee referral hiring. Consistent with the existing policy, the guidance reaffirmed that employees were prohibited from hiring client relationship candidates in connection with obtaining or retaining business from anyone, whether the client was a private client or government entity. The policy also emphasized that all candidates must follow the “standard and independent merit based recruitment process.”

In February 2013, APAC bankers sought to hire the nephew of the CEO of a key private client. An APAC compliance officer consulted with Barclays’ global compliance about the request from the key private client, which led to a review of the work experience program. Barclays’ global compliance agreed that the hiring recommendation had been preordained: “[I]t appears the business contacts made a ‘hiring’ determination and then sent the candidate to HR for processing.” Despite this, the candidate, who had previously been rejected in late 2012 during the merit-based competition for the formal summer intern program, was nevertheless offered a position in March 2013 as part of the formal summer intern program in APAC. Barclays records related to the hire contain no indication that the compliance department was consulted or even made aware of the March 2013 offer, despite the explicit requirement in the January 2013 guidance. In May 2013, Barclays earned over $2.6 million in revenue from the CEO’s business.

On September 30, 2013, in response to news reports of investigations into relationship hiring practices at other financial institutions in APAC, Barclays further tightened its hiring policy and implemented enhanced controls aimed toward ensuring future hires would be made in compliance with its anti-bribery and corruption policies and applicable law.

The SEC cited the fact that Barclays voluntarily disclosed the conduct, undertook remedial measures by terminating senior executives and other employees involved in the misconduct, revised its hiring policies and procedures, and enhanced its compliance programs.

Barclays’ cooperation included providing facts developed during the course of its own internal investigation, providing focused presentations regarding its hiring practices, and voluntarily producing voluminous records including detailed spreadsheets related to specific hires and key document binders. Barclays also made its employees available for interviews upon request and facilitated the interviews of former employees by the SEC’s staff, including interviews of certain witness who traveled internationally.