Justice Department Files to Block Penguin Random House’s Acquisition of Simon and Schuster

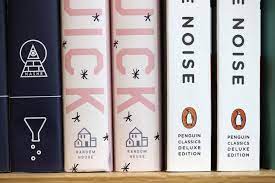

The Justice Department filed a complaint in the US District Court for the District of Columbia to block Penguin Random House’s acquisition of Simon & Schuster. Penguin Random House is the largest book publisher in the world and Simon & Shuster is the fourth largest publisher.

Penguin Random House is a subsidiary of Bertelsmann SE and is based in New York City. Penguin Random House’s annual revenues is approximately $2.4 billion from US publishing.

Simon & Schuster is a subsidiary of Viacom CBS and is located in New York City. Simon & Schuster’s annual revenue is approximately $760 million from US publishing.

The Antitrust Division’s filing represents an aggressive commitment to merger enforcement under the Biden Administration. In keeping with DOJ’s new administration, the Antitrust Division is expected to increase merger enforcement activities. This is the third proposed merger challenged by the Biden DOJ.

Penguin Random House has proposed to purchase Simon & Schuster for $2.175 billion. Penguin Random House’s market share would increase to over 50 percent of the entire publishing market.

As explained in the court filing, the proposed merger, if permitted, would allow Penguin Random House to increase its control and dominance of the book publishing industry by acquiring one of its chief competitors and rivals in the book publishing business.

Interestingly, DOJ argued that the merger would have both upstream and downstream effects, resulting in the reduction of competition for authors and new literary materials, while also resulting in increased prices for consumers when purchasing books. As explained, book authors will earn lower advances that are an important income stream for authors to produce successful books.

DOJ’s argument relating to impact on writers relied on its analysis of “monopsony” power, meaning the impact on the supply market for acquiring literary products from writers. With respect to consumers of books, DOJ articulated a familiar theory of “market power” impact on consumers of books and related products and services.

According to DOJ, publishers compete to acquire manuscripts from authors and then edit, package, market and distribute as books. Authors depend on advances for their manuscripts.

DOJ cited the fact that the book publishing industry is already concentrated with five significant publishing businesses. Most authors have to sell their manuscripts to one of the five. By allowing the merger to occur, the publishing industry would become even more concentrated. As a consequence, DOJ argued that it is likely that competition would diminish resulting in lower advances, less support for new authors and less favorable contract terms for authors. Consumers would have fewer books and less variety from which to choose.

Penguin Random House’s own documents described the publishing market as an “oligopoly,” and affirmed that its plan was to “cement” its position as the dominant publisher in the United States. DOJ claimed that the merger would give Penguin Random House “outsized influence” over what is published and how much writers are paid. In the current market, DOJ claimed that competition for “authors of anticipated top-selling books” would lessen. Publishers vigorously compete for these high-profile books by providing large advances, editorial support and marketing services. If the merger occurred, DOJ claimed that Penguin Random House would control nearly two-third of the high-profile book publishing market.

In a preview of the arguments in favor of the acquisition, Penguin Random House and Simon & Schuster issued a statement that DOJ’s filing ignores the robust level of competition from other publishers in the industry. The parties also argued that the proposed merger is important to establish the newly-joined entity as a strong competitor against Amazon.

1 Response

[…] Source link […]