2022 Ethics and Compliance Predictions

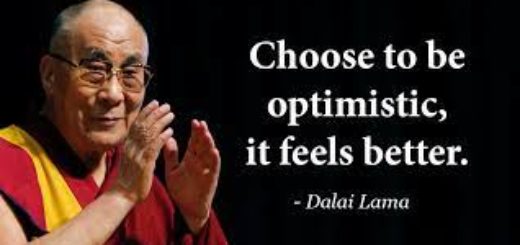

Choose to be optimistic. It feels better.” – Dalai Lama Forgive me for my optimism. It is the only way to live a meaningful life. Or as some would say – being a pessimist is too much of a burden. We begin a New Year — and I am optimistic. To turn the corner here on relevance, ethics and compliance professionals, are by definition, optimists. Give...