The Mindset of Employee Fraudsters (Part III of III)

Technology and computer analytics are important tools in the fight against fraud. But it is not the magic and exclusive bullet. Fraud is committed by humans and investing in the human element, while difficult to measure, is an important part of every fraud prevention strategy.

Technology and computer analytics are important tools in the fight against fraud. But it is not the magic and exclusive bullet. Fraud is committed by humans and investing in the human element, while difficult to measure, is an important part of every fraud prevention strategy.

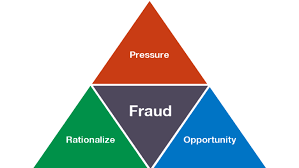

The fraud triangle is an essential framework for understanding fraudster behavior. The fraud triangle is no panacea but it is a powerful tool. The fraud triangle begins with an incentive, an expectation to perform in an organization, followed by an opportunity and an internal rationalization. All three of these drivers must be present for an act of fraud and each can be addressed.

Companies have to reduce the opportunities for fraud. Building effective internal accounting controls is a critical aspect to reducing fraud opportunities. Technology is important here in designing, revising and maintaining effective internal controls. Companies are not devoting significant resources to counteract incentives and rationalizations. Incentives and pressure continue to push employees towards committing fraud.

Internal fraud usually involves gaps in a company’s internal controls and culture. An effective set of internal controls can be effective but should not be relied on as the only strategy for preventing fraud. Controls can be evaded and circumvented and human actors have the authority in certain situations to override or rely on exceptions to controls.

Financial incentives can create opportunities for fraud. However, financial incentives are important for motivating positive sales and related conduct. Human nature searches for and relies on incentives.

At the root of fraud, however, is human rationalizations. This is exemplified by a focus on the self – meaning a rationalization for why an individual is justified in engaging in misconduct, usually because of some perceived slight or mistreatment. A narcissistic employee who is passed over for a specific promotion can feel justified in stealing from the company because of such mistreatment.

The human mind can be difficult to manage when it comes to the mix of emotional and so-called rational thinking patterns. Employee fraudsters are good at rationalizing their misconduct. They perceive their misconduct as victimless – no one is hurt, it is just money. Employees rely on such rationalizations for committing human resources fraud, asset misappropriation, procurement fraud and accounting fraud.

Employee fraud that is directed at advancing a corporate objective – meeting a sales target for a company or a revenue goal – can be easier to rationalize because of the importance of satisfying a corporate objective (while earning a personal benefit, e.g. a bonus).

Employee fraud that is directed at advancing a corporate objective – meeting a sales target for a company or a revenue goal – can be easier to rationalize because of the importance of satisfying a corporate objective (while earning a personal benefit, e.g. a bonus).

In balancing these concerns, a corporate culture of ethical conduct is an essential aspect of any anti-fraud program. An effective culture will reduce opportunities and instances for employee rationalization, while promoting employee reporting of potential misconduct.

Companies have to find the right balance between technology and human behavior. Fraud is a difficult and intractable problem. Proactive strategies are essential to combat and minimize a company’s exposure to fraud risks.